Bitcoin AI Trade Log – 2025 05 12 01:01:14

TIMESTAMP : 2025-05-12 01:01:14

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin now deflationary due to Strategy’s BTC purchases — Analyst”(05/10/2025, 06:02 PM, +0000 UTC)

“1 Huge Reason Bitcoin Will Probably Keep Rising and Rising This Year”(05/11/2025, 10:00 AM, +0000 UTC)

“Standard Chartered analyst apologizes for $120,000 bitcoin price call, says target ‘may be too low'”(05/08/2025, 01:10 PM, +0000 UTC)

“Bitcoin Bull Cycle Isn’t Over—Top Analyst Sees Institutional Tsunami”(05/10/2025, 01:30 AM, +0000 UTC)

Trading Log

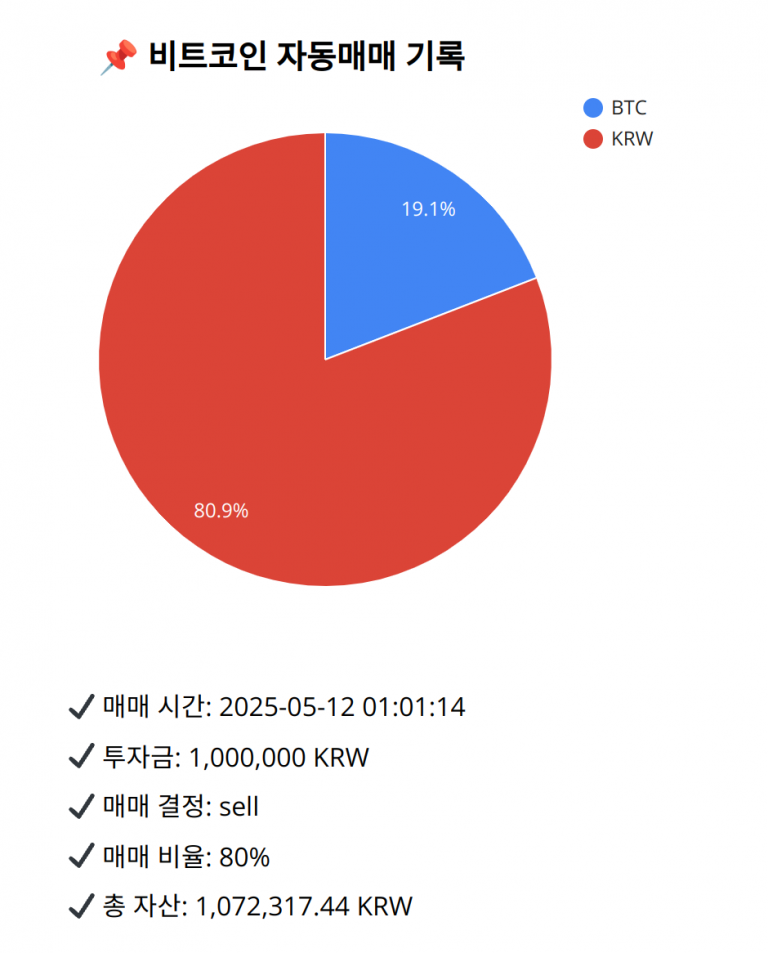

Investment amount: 1,000,000 KRW

BTC current price: 145874000.0 KRW

Reflection: The past 18 trades reflect the importance of aligning strategies with technical signals. Previous buy decisions during golden crosses yielded positive results in bullish conditions but maintaining a dynamic approach with the MACD as an additional filter could enhance performance. Past holds during unclear signals preserved capital during uncertain phases, but failed to maximize on favorable trends. Reflecting on these outcomes suggests a refined approach of leveraging technical warnings, such as current MACD signals, to taken action. The decision to sell a substantial portion today intends to lock in recent gains under current market conditions showing less bullish strength in momentum, aligning with past strategies that prioritized capital preservation in times of potential trend reversals.

Decision: sell

Percentage: 80%

REASON: 1. Latest close price: 145875000

2. SMA values for 5, 20, 60, and 200 days: 144709000, 143807700, 139207333, 131013845

3. RSI value: 66.7641119737

4. MACD value: 1662052.3441872001

5. MACD signal value: 1745128.274640257

6. Bollinger Band: Middle (bb_bbm): 143807700, Upper (bb_bbh): 146850322.2309054136, Lower (bb_bbl): 140765077.7690945864

The 5-day moving average is above the 20-day moving average, suggesting a golden cross, indicating a bullish trend. However, the MACD is showing bearish divergence by being below its signal, indicating weakening momentum. The RSI is relatively high but showing potential for a pullback. The recent candle closes near the Bollinger Band’s upper limit indicate a potential reversal or consolidation area, hinting at resistance. Market sentiment remains positive with ‘Greed’, but technical indicators suggest caution. Selling 80% of BTC aligns with capitalizing on current high prices, reducing exposure in case of a downturn, while maintaining some BTC in case of a continued uptrend.

BTC balance: 0.00140612 BTC

KRW balance: 867201.09266904 KRW

BTC average buy price: 144434262.92135704 KRW

Total assets: 1,072,317.44 KRW