Bitcoin AI Trade Log – 2025 05 12 09:01:13

TIMESTAMP : 2025-05-12 09:01:13

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Crypto Suddenly Braced For A Huge China Earthquake As $1 Million Bitcoin Price Predicted To Flip Gold”(05/10/2025, 10:40 AM, +0000 UTC)

“Standard Chartered analyst apologizes for $120,000 bitcoin price call, says target ‘may be too low'”(05/08/2025, 01:10 PM, +0000 UTC)

“Bitcoin now deflationary due to Strategy’s BTC purchases — Analyst”(05/10/2025, 06:02 PM, +0000 UTC)

“Strategy’s Saylor Teases New Bitcoin Purchases as BTC Price Approaches New ATH”(05/11/2025, 06:54 PM, +0000 UTC)

Trading Log

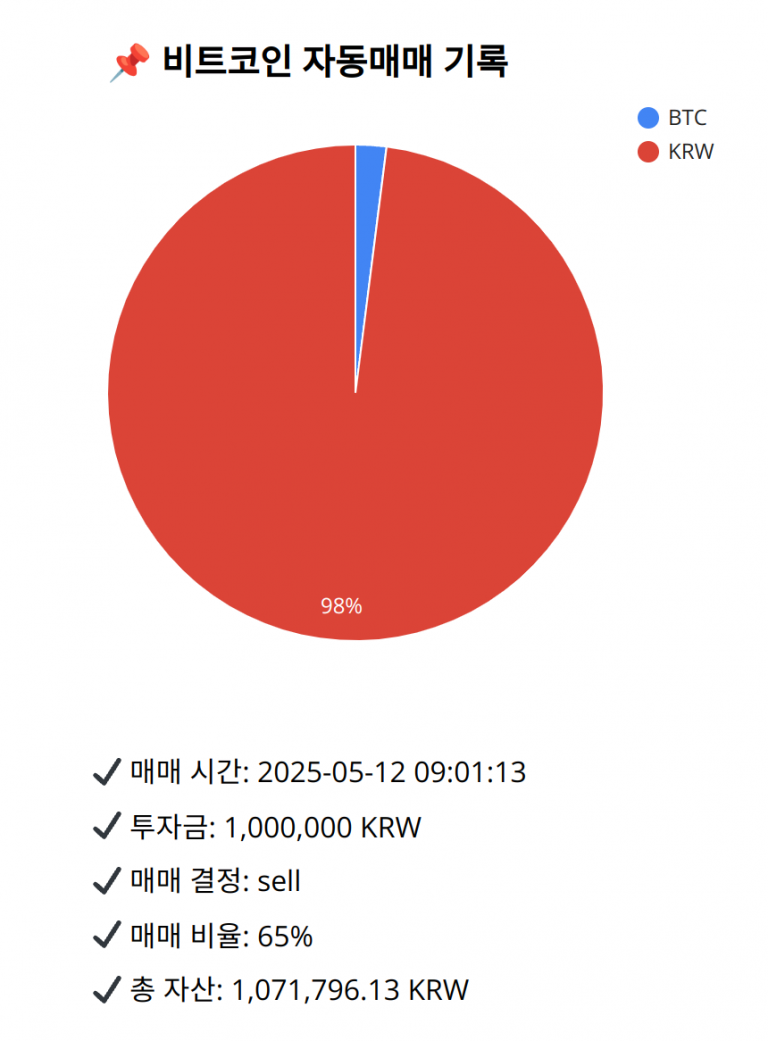

Investment amount: 1,000,000 KRW

BTC current price: 145476000.0 KRW

Reflection: Analyzing the recent 18 trades reflects a consistent approach of risk management by selling off holdings when indicators suggested an impending trend reversal. Historically, this method preserved capital effectively during uncertain phases. The effectiveness of selling during signals like MACD crossovers below the signal line is evident in past resonations with cautious capital management. Given the current market exhibiting similar technical warnings with a history of successful preservation from similar actions, future trades should continue adapting these insights for mitigating potential losses while maintaining a strategic BTC level for bullish possibilities.

Decision: sell

Percentage: 65%

REASON: The latest close price is 145510000 KRW.

The SMA values are:

– 5-day: 145678600

– 20-day: 144702100

– 60-day: 139621650

– 200-day: 131302690

The RSI value is 64.2036030289, suggesting the market is nearing overbought conditions.

The MACD value is 1524522.2227035463, and the MACD signal value is 1672996.4035268158, indicating a bearish crossover, with a MACD lower than the signal which suggests weakening momentum.

The Bollinger Bands are:

– Middle: 144702100

– Upper: 146096354.4817930162

– Lower: 143307845.5182069838

Despite the 5-day SMA being above the 20-day SMA, indicating a golden cross, the MACD bearish divergence and high RSI highlight potential overbought conditions, suggesting a possible downtrend or correction. Current conditions, aligning with past strategies of securing profits during weakening trends, suggest selling 65% of BTC is prudent for preserving gains and increasing cash allocation, while maintaining exposure for potential further uptrend.

BTC balance: 0.00014765 BTC

KRW balance: 1050316.5957957 KRW

BTC average buy price: 144434262.92135704 KRW

Total assets: 1,071,796.13 KRW