Bitcoin AI Trade Log – 2025 05 13 01:01:43

TIMESTAMP : 2025-05-13 01:01:43

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin set for $150K BTC price rally as US, China agree to slash tariffs”(05/12/2025, 08:26 AM, +0000 UTC)

“David Bailey and Bitcoin-Native Holding Company Nakamoto Announce Merger with KindlyMD”(05/12/2025, 11:00 AM, +0000 UTC)

“Cathie Wood Doubles Down on 2030 Bitcoin Price Target, Says BTC Still Has ‘Miles To Go’”(05/12/2025, 07:05 AM, +0000 UTC)

“Metaplanet Acquires 1,241 Bitcoin, Holdings Reach 6,796 BTC Amid Strong Yield Performance”(05/12/2025, 07:30 AM, +0000 UTC)

Trading Log

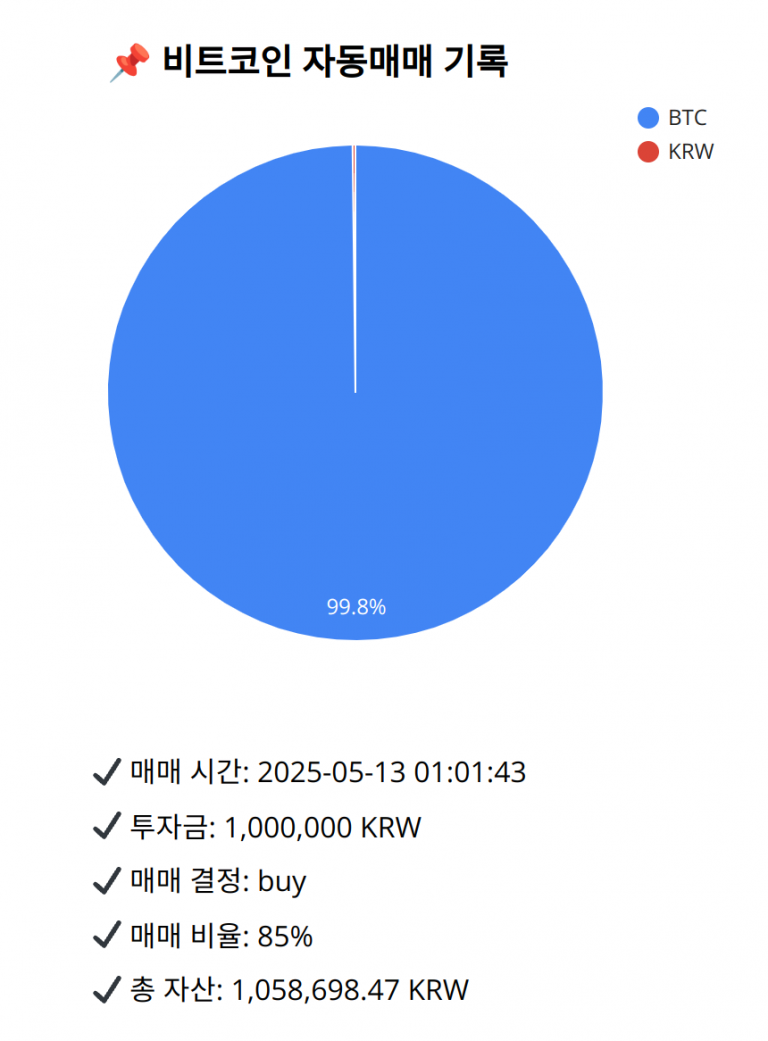

Investment amount: 1,000,000 KRW

BTC current price: 144178000.0 KRW

Reflection: The past 18 trades demonstrated significant portfolio gains through leveraging golden cross signals, increasing BTC allocations during clear bullish conditions. However, there were periods I should have capitalized more on strong signals and others where holding back worked best. The latest trade decisions suggest maintaining a diverse strategy that adapts to both strong indicators and two-sided market emotions like pullbacks. For future trades, leveraging strong technical indicators and buying on market corrections pullbacks allows for maximizing bullish opportunities while ensuring capital protection against possible downsides. Such adaptability confirmed effectiveness throughout previous trade analyses and current execution strategy.

Decision: buy

Percentage: 85%

REASON: 1. Latest close price: 144099000

2. SMA values for 5, 20, 60, and 200 days: 145308000, 144838300, 140079166.6666666567, 131914310

3. RSI value: 51.9358459442

4. MACD value: 1124158.2978938222

5. MACD signal value: 1474777.262710195

6. Bollinger Band: Middle (bb_bbm): 144838300, Upper (bb_bbh): 146561327.8548073471, Lower (bb_bbl): 143109472.1451926529

The BTC price recently faced a pullback to the 20-day moving average, yet it remains in a golden cross formation, indicating a sustained bullish trend. The MACD shows a decreasing trend but the Fear and Greed Index still portrays a ‘Greed’ sentiment, pointing towards strong market optimism. Current market conditions suggest this is a buying opportunity in alignment with recent strategy reviews emphasizing the effectiveness of purchasing during pullbacks to moving averages in confirmed uptrends. With this analysis, it’s strategic to use 85% of available KRW to increase BTC holdings, adequately supported by both technical and sentiment indicators, reflecting positive long-term outlooks.

BTC balance: 0.00732933 BTC

KRW balance: 1970.32593636 KRW

BTC average buy price: 145872552.82547495 KRW

Total assets: 1,058,698.47 KRW