Bitcoin AI Trade Log – 2025 05 15 01:01:33

TIMESTAMP : 2025-05-15 01:01:33

Market Status

Fear-Greed INDEX: 73 (Greed)

News Headlines

“Semler Scientific Has Purchased 1,510 Bitcoin This Year, Now Holds 3,808 BTC”(05/13/2025, 10:35 PM, +0000 UTC)

“$1B Bitcoin exits Coinbase in a day as analysts warn of supply shock”(05/13/2025, 02:36 PM, +0000 UTC)

“David Bailey and Bitcoin-Native Holding Company Nakamoto Announce Merger with KindlyMD”(05/12/2025, 11:00 AM, +0000 UTC)

Trading Log

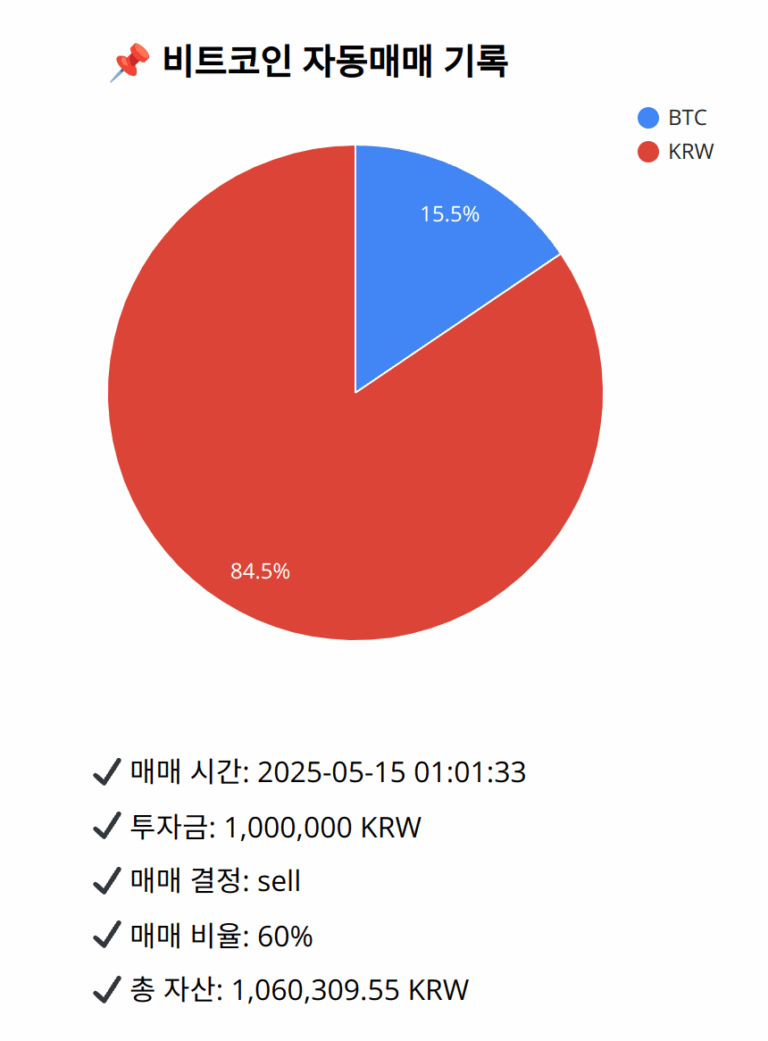

Investment amount: 1,000,000 KRW

BTC current price: 145506000.0 KRW

Reflection: Analyzing past trades reveals that adjusting Bitcoin allocation in response to technical indicators, especially MACD and SMA developments, significantly impacts protecting gains and preserving capital. Successful historical strategies involved scaling down BTC positions during bearish MACD crossovers or when prices hovered uncertainly around major moving averages. It is vital to secure recent gains, given the latest signals express weakening momentum. Given these conditions, offloading a portion of the BTC position aligns with past successful practices, optimizing current portfolio dynamics for potential volatility. Future decisions should consistently draw on these technical insights to ensure strategic alignment and continued portfolio growth.

Decision: sell

Percentage: 60%

REASON: 1. Latest close price: 145590000

2. SMA values for 5, 20, 60, and 200 days: 145721200, 145536400, 141684200, 133483100

3. RSI value: 54.8632895975

4. MACD value: 666193.4670470953

5. MACD signal value: 844471.6633717375

6. Bollinger Band: Middle (bb_bbm): 145536400, Upper (bb_bbh): 147151490.6352267563, Lower (bb_bbl): 143921309.3647732437

Despite the price being near the 20-day SMA and slightly indicating an ongoing uptrend (with the 5-day SMA above the 20-day SMA), there is a notable bearish MACD crossover below the signal line, indicating a potential decline in momentum. The RSI illustrates a relatively neutral reading, suggesting there isn’t an imminent upward push, and the MACD confirms diminishing momentum. The current close is near the Bollinger Band’s middle line, highlighting a weaker upward push. Historical reflections indicate a time to reduce exposure when indicators signal weakening trends. Therefore, selling 60% of BTC is recommended to safeguard previous gains while maintaining some BTC in case of a resumption in upward momentum.

BTC balance: 0.00113105 BTC

KRW balance: 895734.99212648 KRW

BTC average buy price: 145850458.3870351 KRW

Total assets: 1,060,309.55 KRW