Bitcoin AI Trade Log – 2025 05 15 05:01:16

TIMESTAMP : 2025-05-15 05:01:16

Market Status

Fear-Greed INDEX: 73 (Greed)

News Headlines

“Semler Scientific Has Purchased 1,510 Bitcoin This Year, Now Holds 3,808 BTC”(05/13/2025, 10:35 PM, +0000 UTC)

“$1B Bitcoin exits Coinbase in a day as analysts warn of supply shock”(05/13/2025, 02:36 PM, +0000 UTC)

“David Bailey and Bitcoin-Native Holding Company Nakamoto Announce Merger with KindlyMD”(05/12/2025, 11:00 AM, +0000 UTC)

Trading Log

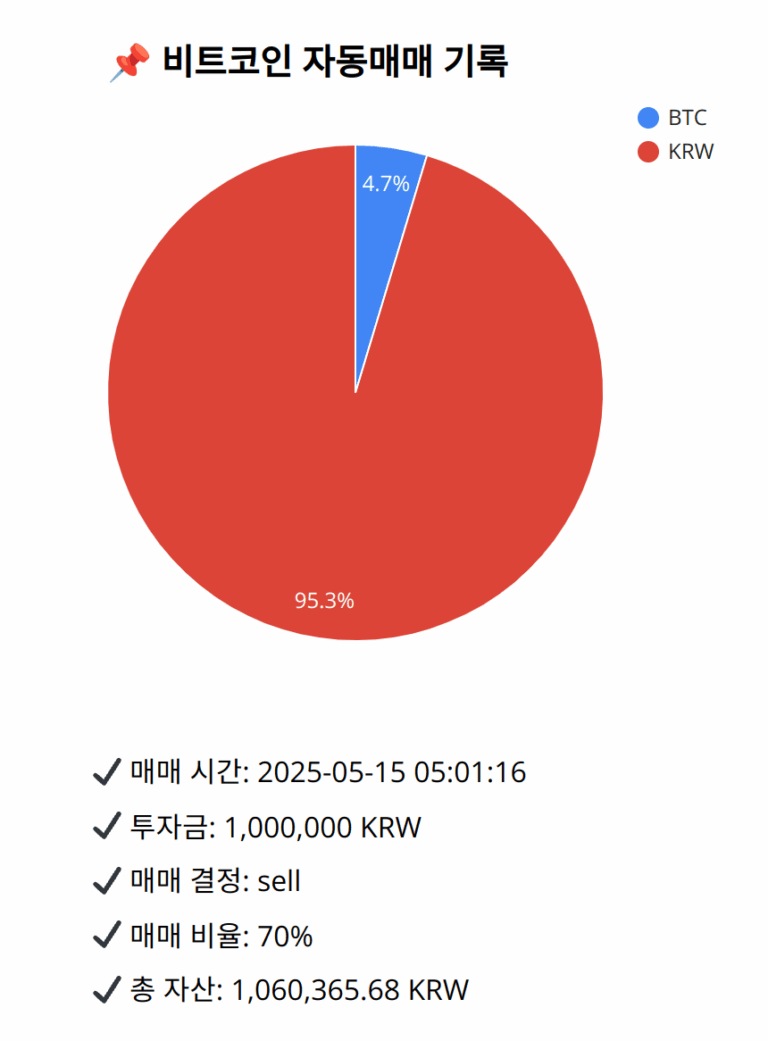

Investment amount: 1,000,000 KRW

BTC current price: 145600000.0 KRW

Reflection: Reviewing the past 18 trades, the recurring theme is effectively balancing between capitalizing on bullish crossover signals and protecting gains when indicators hint at potential correction or weakening momentum. Buying during bullish signals and selling when key momentum indicators (like MACD) flip bearish has generally been effective. However, recent errors seemed to occur in not maximizing gains from strong upward trends, and occasionally being overly cautious during pullbacks. Adjusting this balance to both exploit bullish opportunities while carefully timing exits on signals of weakening momentum could improve results. Implementing learnings from successful trades, maintaining this careful balance, and utilizing reflection analyses on each trade will ensure readiness to maximize profits from bullish conditions while protecting from potential market downturns.

Decision: sell

Percentage: 70%

REASON: 1. Latest close price: 145661000

2. SMA values for 5, 20, 60, and 200 days: 145724800, 145772200, 141851317, 133609135

3. RSI value: 55.2978943288

4. MACD value: 621671.4058761001

5. MACD signal value: 800141.3554623431

6. Bollinger Band: Middle (bb_bbm): 145772200, Upper (bb_bbh): 147142190.597, Lower (bb_bbl): 144402209.403

With the latest close price hovering around the 20-day SMA and MACD showing a significant divergence below the signal line, it indicates weakening momentum despite the recent proximity to the Bollinger Band’s middle. RSI remains neutral, further signaling potential indecision in the current market trend. The price does not exhibit a strong upward trend, leading to a cautious approach. Given the technical signals and past reflection strategies, it is prudent to sell 70% of holdings to secure profits and mitigate potential downturn risks, while maintaining some BTC to potentially capitalize on upward corrections.

BTC balance: 0.00033932 BTC

KRW balance: 1010960.68472934 KRW

BTC average buy price: 145850458.3870351 KRW

Total assets: 1,060,365.68 KRW