Bitcoin AI Trade Log – 2025 05 15 09:01:28

TIMESTAMP : 2025-05-15 09:01:28

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“David Bailey and Bitcoin-Native Holding Company Nakamoto Announce Merger with KindlyMD”(05/12/2025, 11:00 AM, +0000 UTC)

“Metaplanet Delivers Record-Breaking Q1 With Massive Bitcoin Treasury Growth”(05/14/2025, 05:32 PM, +0000 UTC)

“The Lucky Miner USB stick is a $24 Bitcoin lottery ticket, with 210.7 trillion-to-one odds of mining a BTC block in a year”(05/12/2025, 01:32 PM, +0000 UTC)

Trading Log

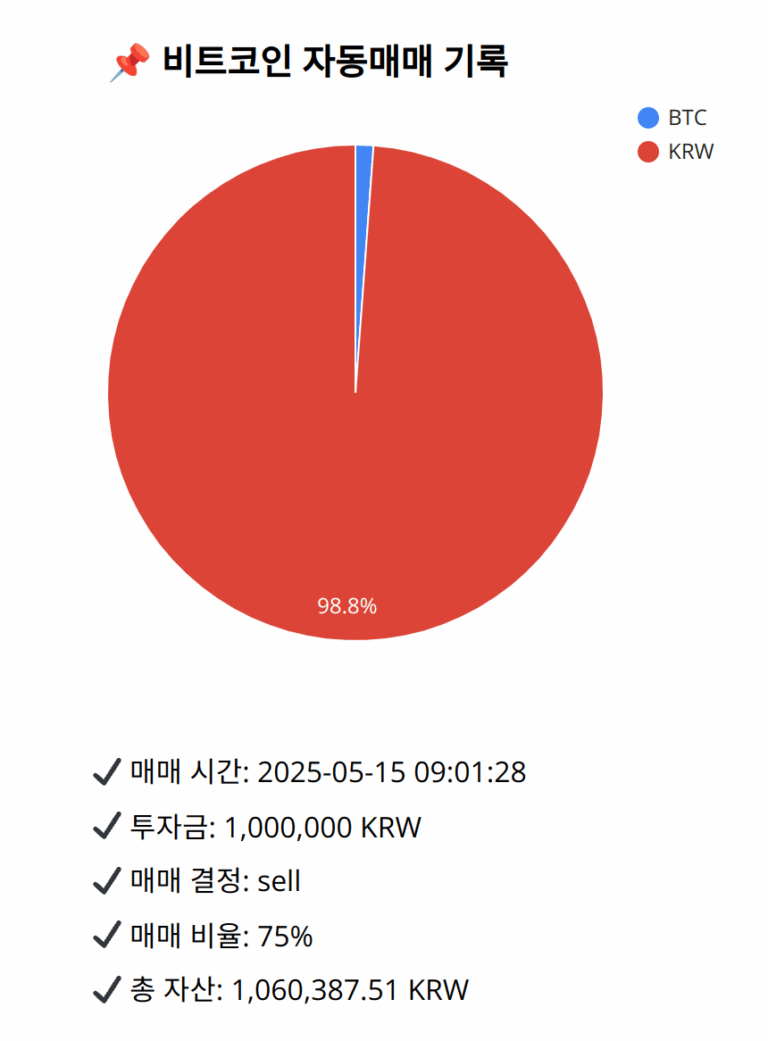

Investment amount: 1,000,000 KRW

BTC current price: 145719000.0 KRW

Reflection: The examination of the last 18 trades shows consistent success in protecting gains by reducing exposure once technical indicators, such as the MACD, suggest decreasing momentum. Historically, maintaining or increasing holdings during a weakening trend without clear indications of support or reversal has led to suboptimal results. The past reflection analyses highlight this strategy’s effectiveness, and thus, aligning current decisions with these realizations minimizes risk exposure. Continuing this approach, therefore, adheres to the established strategy of capitalizing on momentum shifts to safeguard portfolio value.

Decision: sell

Percentage: 75%

REASON: 1. Latest close price: 145793000

2. SMA values for 5, 20, 60, and 200 days: 145669400, 145542150, 142041066.6666666567, 133730735

3. RSI value: 56.0789311258

4. MACD value: 592062.0471178293

5. MACD signal value: 759253.0151609619

6. Bollinger Band: Middle (bb_bbm): 145542150, Upper (bb_bbh): 147158627.0675763488, Lower (bb_bbl): 143925672.9324236512

The recent close price is slightly above the 20-day SMA, indicating potential support, but the MACD has significantly diverged below its signal line, indicating weakening momentum. The RSI is not at overbought levels but sits at a neutral position. The overall positioning close to the middle Bollinger Band indicates limited upward momentum. Given the historical success in selling during conditions of weakening momentum and aligning with previous strategies of preserving gains during neutral momentum periods, selling 75% of BTC is prudent to secure profits and reduce potential exposure to risks from a potential price decline.

BTC balance: 8.483e-05 BTC

KRW balance: 1048026.17102519 KRW

BTC average buy price: 145850458.3870351 KRW

Total assets: 1,060,387.51 KRW