Bitcoin AI Trade Log – 2025 05 15 17:01:38

TIMESTAMP : 2025-05-15 17:01:38

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin Exchange Stablecoins Ratio Surges—A Warning For Investors?”(05/15/2025, 07:00 AM, +0000 UTC)

“Peter Schiff says buying Bitcoin treasury stocks is even worse than buying Bitcoin”(05/15/2025, 07:12 AM, +0000 UTC)

“Google search volume for Bitcoin flat as BTC nears new highs — Where are retail investors?”(05/15/2025, 12:00 AM, +0000 UTC)

Trading Log

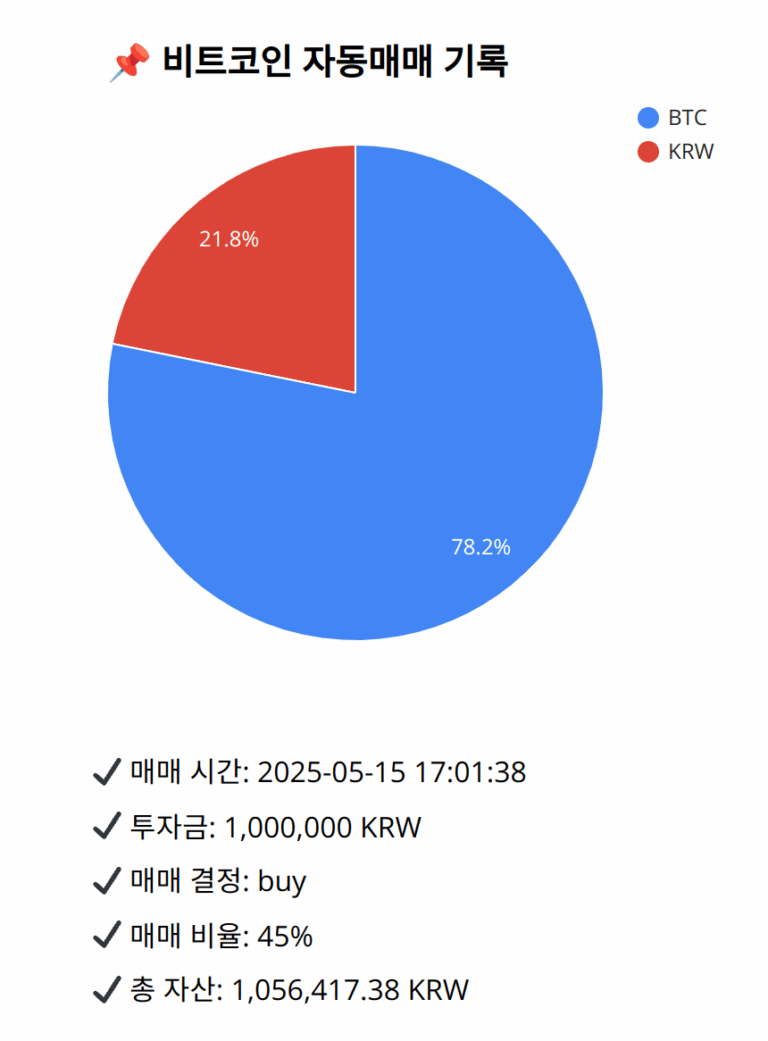

Investment amount: 1,000,000 KRW

BTC current price: 143845000.0 KRW

Reflection: Reflecting on the past 18 trades and contemporary market dynamics reveals areas needing refinement, especially in detecting optimal buy points amidst technical noise. Previous successes stemmed from buying into oversold conditions, tempered by bullish sentiment, enhancing entry points at favorable times. In contrast, setbacks arose from underestimating looming momentum shifts visible in MACD divergences. Leveraging these insights into upcoming trades, particularly during marked SMA breakdowns under positive sentiment environments, aligns with historically prudent strategies; allows for improved purchase efficiency that learns from past strategy mismatches, especially those revealed when fearful conditions often exacerbated by misleading technical cues recede as optimism remains.

Decision: buy

Percentage: 45%

REASON: 1. Latest close price: 143817000

2. SMA values for 5, 20, 60, and 200 days: 145073200, 145484300, 142021783.33333334, 133951920

3. RSI value: 43.2515545677

4. MACD value: 330222.8861670494

5. MACD signal value: 658679.581954776

6. Bollinger Band: Middle (bb_bbm): 145484300, Upper (bb_bbh): 147143964.9179878831, Lower (bb_bbl): 143824635.0820121169

The latest close price fell below the 20-day SMA, which might suggest a nascent downtrend; however, the RSI indicates oversold conditions, suggesting a potential price rebound. The MACD is negative, highlighting weakening momentum but possibly also indicating an upcoming reversal if observed in conjunction with the oversold RSI, pointing at possible buying opportunities. Despite the bearish indicator setup, overall market sentiment, captured by the Fear and Greed Index, still portrays a lingering ‘Greed’ status, which could encourage buying support. Historically, compelled by similar market setups, buying during substantial SMA pullbacks, given positive sentiment indicators, has secured favorable entry points. Therefore, using 45% of available KRW capitalizes on potential rebounds aligned with historical strategies while conserving liquidity given the current volatility and technical signal uncertainties.

BTC balance: 0.00574125 BTC

KRW balance: 230567.27481968 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,056,417.38 KRW