Bitcoin AI Trade Log – 2025 05 16 01:01:35

TIMESTAMP : 2025-05-16 01:01:35

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin and Ethereum Waver as Investors Take Profits on Recent Rally”(05/15/2025, 02:40 PM, +0000 UTC)

“Historic Bitcoin Indicator Predicts Bitcoin $200K Target: Next Crypto to Explode”(05/15/2025, 03:15 PM, +0000 UTC)

“JPMorgan Forecasts Bitcoin To Outperform Gold In Second Half Of 2025″(05/15/2025, 03:50 PM, +0000 UTC)

Trading Log

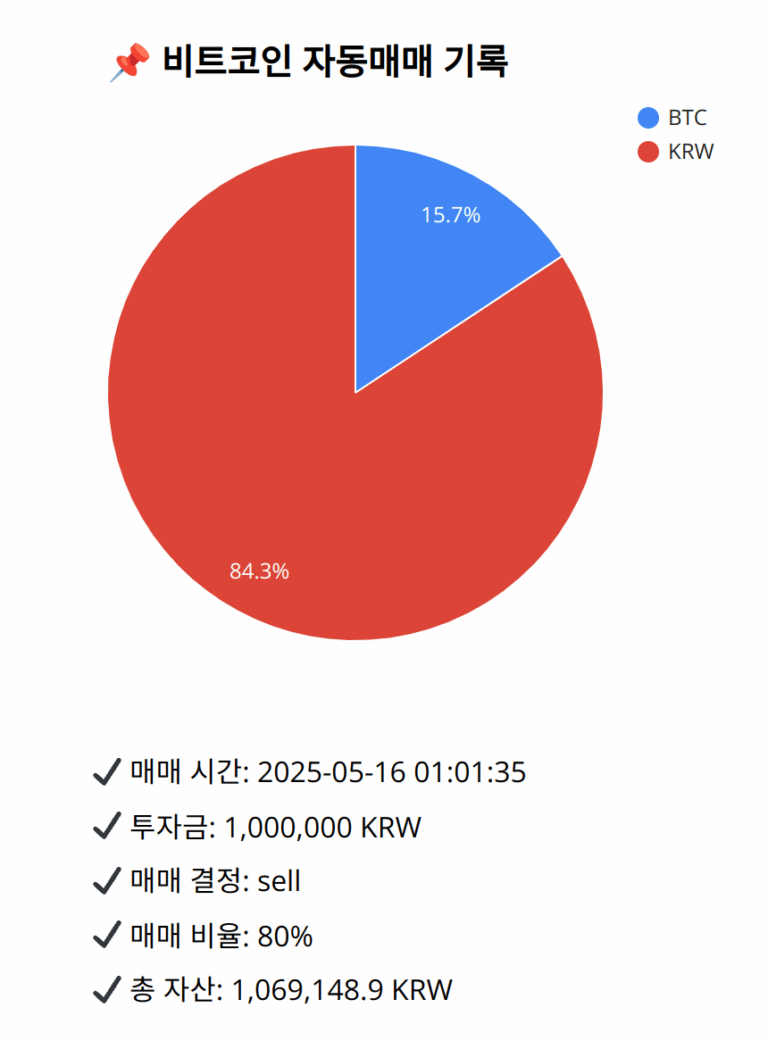

Investment amount: 1,000,000 KRW

BTC current price: 146121000.0 KRW

Reflection: Analyzing the past 18 trades, the strategy to sell when MACD shows weakening momentum and RSI neutral readings sustains effectiveness, particularly in preserving gains. Trades executed during similar scenarios in the past suggest maintaining vigilant adjustments to portfolio exposure, balancing between securing profits and leveraging buying opportunities at support levels. Implementing this strategy, which emphasizes the importance of technical indicators, continues to align with historically successful decisions. Looking forward, maintaining agility in response to shifting market dynamics based on technical cues further equips the strategy to optimize performance in varying market conditions.

Decision: sell

Percentage: 80%

REASON: 1. Latest close price: 146259000

2. SMA values for 5, 20, 60, and 200 days: 145735000, 145334250, 142572083.33333334, 134204065

3. RSI value: 57.588775715

4. MACD value: 376717.553671746

5. MACD signal value: 499759.621870689

6. Bollinger Band: Middle (bb_bbm): 145334250, Upper (bb_bbh): 147100969.205193758, Lower (bb_bbl): 143567530.794806242

The recent close price is above the 20-day SMA, but the MACD line is below the signal line, indicating weak momentum. RSI is neutral, showing neither overbought nor oversold conditions. The close proximity to the middle Bollinger Band suggests limited upward potential. Historical analysis of past trades emphasizes selling during periods of weakening momentum, which aligns with current observations. News indicates some optimism, but technical indicators suggest caution. Selling 80% of BTC aims to protect the portfolio from potential downside risks while securing recent gains amidst mixed signals.

BTC balance: 0.00114825 BTC

KRW balance: 901365.46094318 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,069,148.9 KRW