Bitcoin AI Trade Log – 2025 05 16 05:01:34

TIMESTAMP : 2025-05-16 05:01:34

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin and Ethereum Waver as Investors Take Profits on Recent Rally”(05/15/2025, 02:40 PM, +0000 UTC)

“Historic Bitcoin Indicator Predicts Bitcoin $200K Target: Next Crypto to Explode”(05/15/2025, 03:15 PM, +0000 UTC)

“JPMorgan Forecasts Bitcoin To Outperform Gold In Second Half Of 2025″(05/15/2025, 03:50 PM, +0000 UTC)

Trading Log

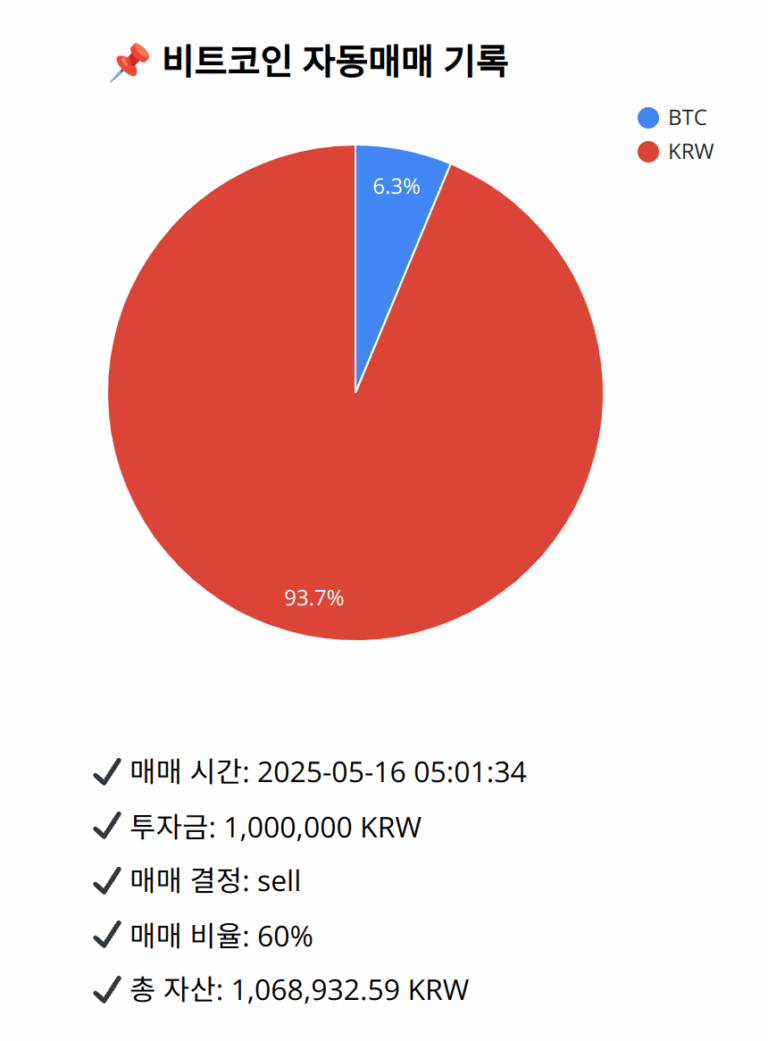

Investment amount: 1,000,000 KRW

BTC current price: 146046000.0 KRW

Reflection: Reviewing past trades underscores the importance of selling when indicators suggest weakening momentum, such as a downward MACD crossover. This approach proved effective in preserving portfolio gains under similar conditions. The principle strategy relies on aligning technical indicators with broader sentiment shifts. Current sentiment combines optimism with technical caution, reaffirming the stratagem of reducing exposure until a clearer trend asserts itself. This method, continually affirmed, helps navigate uncertainty without forgoing opportunity. Hence, reducing exposure adapts to signal changes while securing profits.

Decision: sell

Percentage: 60%

REASON: 1. Latest close price: 145990000

2. SMA values for 5, 20, 60, and 200 days: 145309600, 145414150, 142949816.6666666567, 134317005

3. RSI value: 56.0738942306

4. MACD value: 368186.2062715888

5. MACD signal value: 468454.3974403574

6. Bollinger Band: Middle (bb_bbm): 145414150, Upper (bb_bbh): 147061024.7705881894, Lower (bb_bbl): 143767275.2294118106

Reflection on historical trades shows consistent success when protecting capital by selling during weakening momentum. The MACD is below the signal line, reinforcing signs of slowing momentum despite the price being close to the 20-day SMA. RSI remains neutral, and there is limited momentum beyond the middle Bollinger Band. News highlights mixed sentiment, with more bullish signals needed for a buy. Thus, selling 60% of BTC balances preserving gains with maintaining portfolio exposure, conforming to tested strategies without overreacting to minor pullbacks.

BTC balance: 0.00045931 BTC

KRW balance: 1001852.20663608 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,932.59 KRW