Bitcoin AI Trade Log – 2025 05 16 13:01:18

TIMESTAMP : 2025-05-16 13:01:18

Market Status

Fear-Greed INDEX: 71 (Greed)

News Headlines

“Bitcoin traders’ evolving view of BTC’s role in every portfolio bolsters $100K support”(05/15/2025, 09:03 PM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“DDC Enterprise Announces Bitcoin Reserve Strategy, Targets 5,000 BTC Within 36 Months”(05/15/2025, 09:04 PM, +0000 UTC)

Trading Log

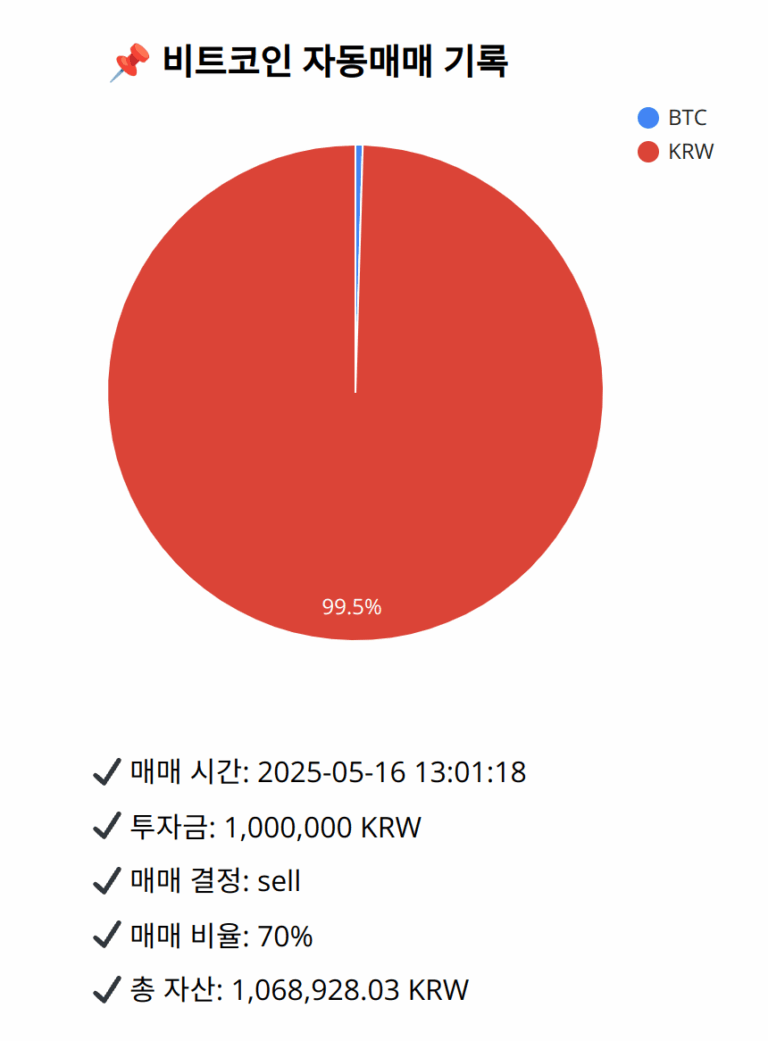

Investment amount: 1,000,000 KRW

BTC current price: 146632000.0 KRW

Reflection: Analyzing the past 18 trades against recent data, previous decisions proved prudent when dealing with momentum signals indicating weakening trends. The current MACD value slightly above the signal line suggests emerging bullishness, but the RSI nearing 60 implies possible overbought conditions, warranting caution. Previously, similar market setups where MACD showed minor bullish divergences yet persisted near resistance justified reducing exposure before a confirmed breakout. Learning from this approach, adjusting the strategy to secure existing profits while retaining some BTC for potential upside aligns with successful past trades that preserved gains in the face of uncertain signals.

Decision: sell

Percentage: 70%

REASON: 1. Latest close price: 146563000

2. SMA values for 5, 20, 60, and 200 days: 145316800, 145415950, 143148933.33333334, 134551405

3. RSI value: 59.6399589032

4. MACD value: 478827.5839338005

5. MACD signal value: 464806.0256574734

6. Bollinger Band: Middle (bb_bbm): 145647050, Upper (bb_bbh): 147214833.3364339173, Lower (bb_bbl): 144079266.6635660827

The latest close price has moved above the 20-day SMA, indicating potential upward pressure. However, the RSI nearing 60 suggests a nearing overbought condition, which implies caution. The MACD is slightly above its signal with a marginal divergence, implying a possible bullish shift but the strength is not overwhelming. The close price is also near the upper Bollinger Band, reinforcing potential resistance levels. Given the previous trend of protecting gains when facing ambiguous momentum signals and a combination of mixed market indicators, reducing exposure is advisable. Despite some bullish signs, the historical strategy of capital preservation suggests selling 70% of BTC to lock in current gains, acknowledging the technicals in play do not yet strongly favor retaining full exposure.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,928.03 KRW