Bitcoin AI Trade Log – 2025 05 16 17:01:20

TIMESTAMP : 2025-05-16 17:01:20

Market Status

Fear-Greed INDEX: 71 (Greed)

News Headlines

“Altcoin Season Could Heat Up in June and Drain Part of Bitcoin’s $2T Market Cap, Analyst Says”(05/15/2025, 09:22 AM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“Virtune AB (Publ) is launching Virtune Bitcoin Prime ETP on Nasdaq Stockholm”(05/16/2025, 07:10 AM, +0000 UTC)

“DDC Enterprise Ltd adopts Bitcoin as strategic reserve asset, sets sights on 5,000 BTC over three years”(05/16/2025, 05:44 AM, +0000 UTC)

“Bitcoin Futures Analysis with tradeCompass”(05/16/2025, 07:34 AM, +0000 UTC)

Trading Log

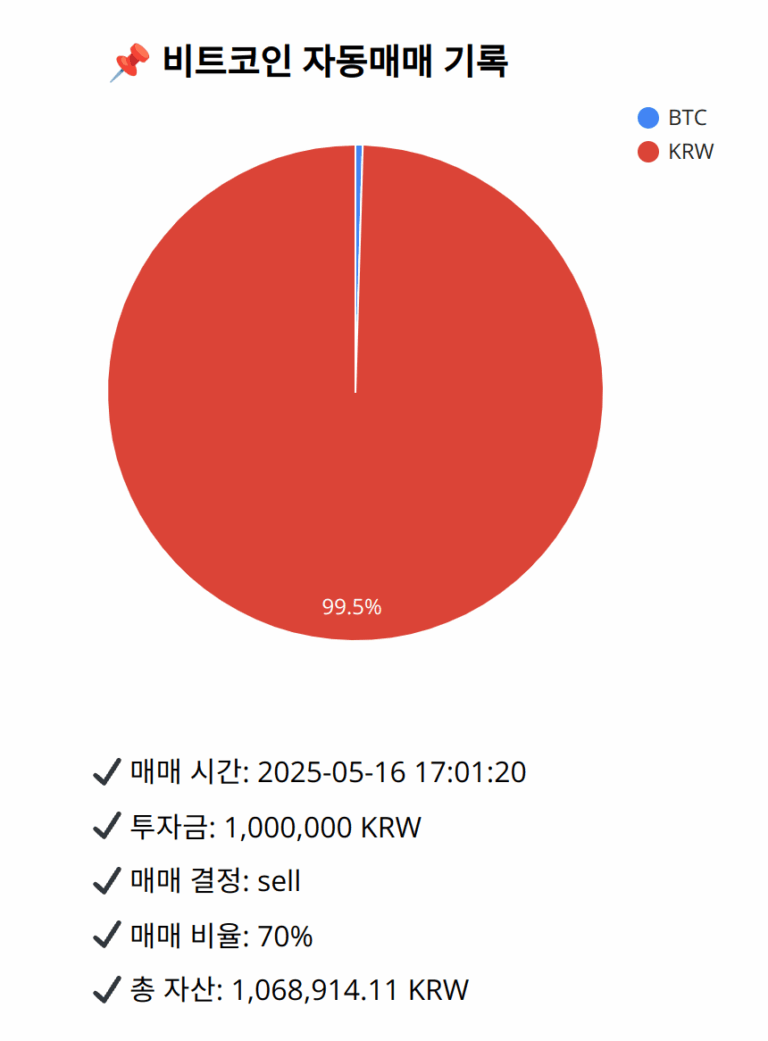

Investment amount: 1,000,000 KRW

BTC current price: 146228000.0 KRW

Reflection: Reflecting on the past 18 trades in conjunction with the latest data indicates a consistent pattern of effective results when adhering to signals of technical weakening, particularly around mixed indicators and potential price resistance levels. The recent trend shows market sentiment nearing points of reversal or critical levels, making it a prudent strategy to reduce exposure and align with the proven tendency of securing gains amidst uncertainty. Learning from past trades, the decision-making process should consistently address scenarios where clarity diminishes, thus preserving previous gains and readiness for subsequent opportunities without overt exposure.

Decision: sell

Percentage: 70%

REASON: 1. Latest close price: 146236000

2. SMA values for 5, 20, 60, and 200 days: 146139800, 145624650, 143547683.3333333, 134661010

3. RSI value: 56.6452

4. MACD value: 450065.658063978

5. MACD signal value: 456139.8894607091

6. Bollinger Band: Middle (bb_bbm): 145741350, Upper (bb_bbh): 147061079.4078711271, Lower (bb_bbl): 144421620.5921288729

The current close price slightly surpasses the 20-day SMA, and trading above this range often suggests a bullish indicator. However, the MACD is barely below the signal line, indicating a potential pause in upward momentum. RSI sitting below 60 reveals neither overbought nor oversold conditions, yet remains in a zone reflecting some residual strength. The close price encroaches the upper Bollinger Band, a potential point of resistance. Reflecting on historical strategies has seen consistent success in profit preservation by selling during such mixed signals with looming resistance, hence the decision to sell 70% of BTC maintains capital safety by capitalizing on realized gains while hedging against downside risks.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,914.11 KRW