Bitcoin AI Trade Log – 2025 05 16 21:01:14

TIMESTAMP : 2025-05-16 21:01:14

Market Status

Fear-Greed INDEX: 71 (Greed)

News Headlines

“Altcoin Season Could Heat Up in June and Drain Part of Bitcoin’s $2T Market Cap, Analyst Says”(05/15/2025, 09:22 AM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“Virtune AB (Publ) is launching Virtune Bitcoin Prime ETP on Nasdaq Stockholm”(05/16/2025, 07:10 AM, +0000 UTC)

“DDC Enterprise Ltd adopts Bitcoin as strategic reserve asset, sets sights on 5,000 BTC over three years”(05/16/2025, 05:44 AM, +0000 UTC)

“Bitcoin Futures Analysis with tradeCompass”(05/16/2025, 07:34 AM, +0000 UTC)

Trading Log

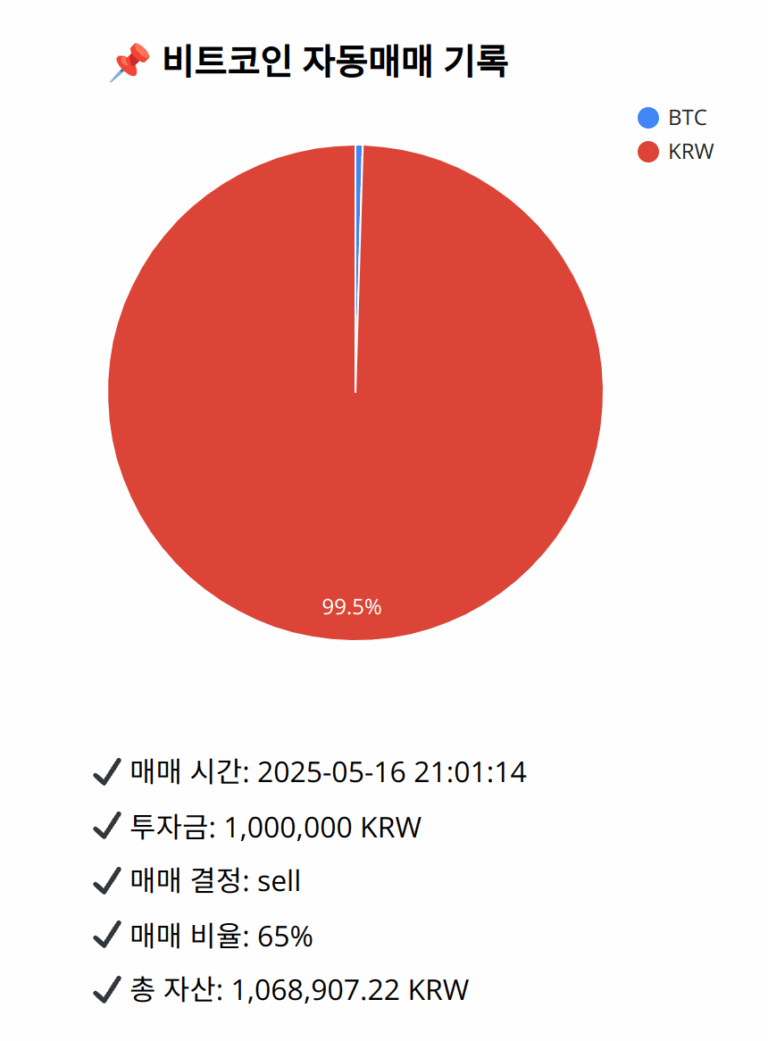

Investment amount: 1,000,000 KRW

BTC current price: 146028000.0 KRW

Reflection: Reviewing the past 18 trades with current data, the consistent theme is achieving success by reacting to technical indicators, particularly using the MACD and SMA relationships. Past sell decisions focused on capital protection during signals of momentum shifts, which has preserved portfolio gains. Mistakes involved over-allocating during unclear upward trends, highlighting the need for balanced exposure strategies. Improvement could focus on refining the timing of entries and exits based on clearer trend confirmations and maintaining vigilance in watching for potential momentum reversals. These learnings emphasize proceeding with caution when indicators point to potential trend weakening, allowing adjustments without drastic exposure changes to align with overall strategic goals.

Decision: sell

Percentage: 65%

REASON: 1. Latest close price: 146028000

2. SMA values for 5, 20, 60, and 200 days: 145867800, 145732750, 143701417, 134767030

3. RSI value: 55.115475357

4. MACD value: 423216.0620501339

5. MACD signal value: 447359.7963432939

6. Bollinger Band: Middle (bb_bbm): 145770550, Upper (bb_bbh): 147067675.9730651081, Lower (bb_bbl): 144473424.0269348919

The latest close price is slightly above the 20-day SMA, indicating short-term positive momentum. However, the MACD is below its signal line, suggesting weakening bullish momentum. The RSI is neutral, signifying neither overbought nor oversold conditions. The price is near the upper part of the Bollinger Bands, indicating potential resistance and limited upside. Given historical success in reducing exposure under similar weakening momentum conditions, selling 65% of BTC aligns with preserving gains while retaining some portfolio exposure for potential upswings.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,907.22 KRW