Bitcoin AI Trade Log – 2025 05 17 09:01:21

TIMESTAMP : 2025-05-17 09:01:21

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend”(05/16/2025, 07:52 AM, +0000 UTC)

“Bitcoin hitting $220K ‘reasonable’ in 2025, says gold-based forecast”(05/16/2025, 07:57 AM, +0000 UTC)

“DDC Enterprise Announces Bitcoin Reserve Strategy, Targets 5,000 BTC Within 36 Months”(05/15/2025, 09:04 PM, +0000 UTC)

Trading Log

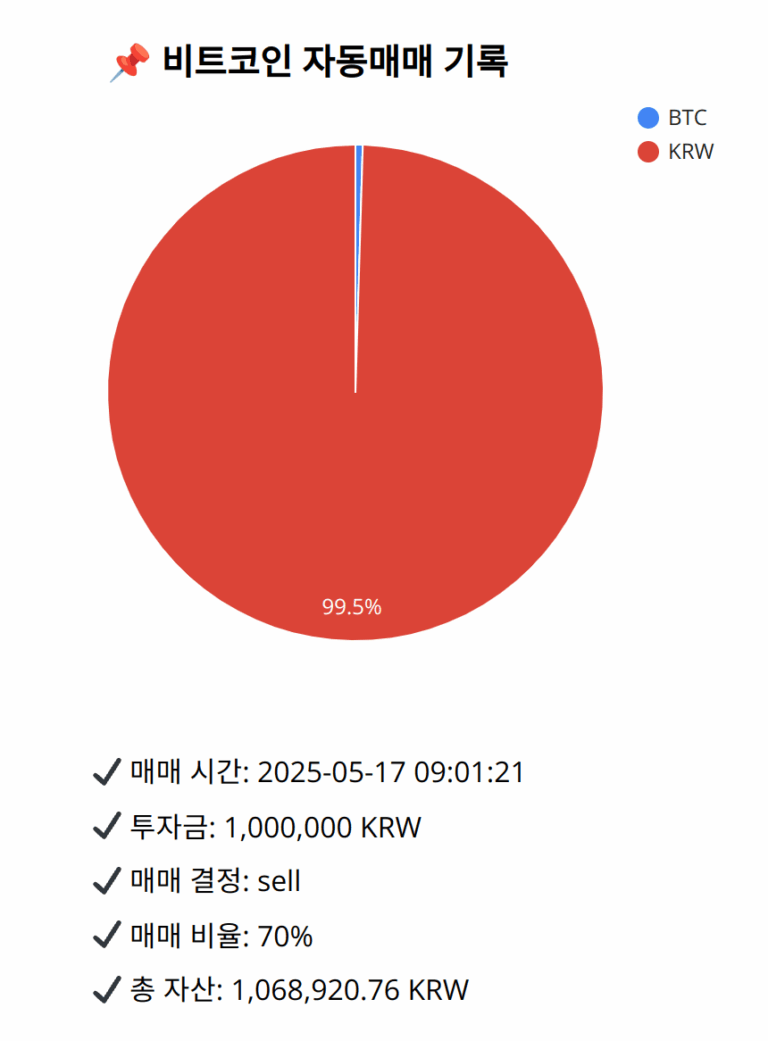

Investment amount: 1,000,000 KRW

BTC current price: 146421000.0 KRW

Reflection: Reflecting on the past 18 trades, consistent results were achieved by adjusting positions according to momentum signals, especially when technical indicators like the MACD suggested weakening momentum. While earlier analysis showed missed opportunities when not fully capitalizing on gains during strong uptrends, subsequent reflective adjustments have improved decision-making timing, ensuring profits are secured during possible downturns. This method reinforces the strategy of adapting to signal changes while maintaining some exposure to benefit from potential upside, balancing between capital protection and growth opportunities.

Decision: sell

Percentage: 70%

REASON: 1. Latest close price: 146528000

2. SMA values for 5, 20, 60, and 200 days: 145639200, 145830550, 143756750, 134819220

3. RSI value: 60.092103252

4. MACD value: 522635.1527526379

5. MACD signal value: 472064.0983943922

6. Bollinger Band: Middle (bb_bbm): 145830550, Upper (bb_bbh): 147258161.3481195271, Lower (bb_bbl): 144408338.6518804729

The recent close price is slightly above the 20-day SMA, indicating potential short-term strength. However, the MACD has begun showing signs of potential momentum weakening, as it is slightly above the signal line. The RSI is nearing overbought conditions at 60, suggesting a potential pause or reversal. Additionally, the close price is approaching the upper Bollinger Band, indicating possible resistance. Past reflections on similar conditions favored selling to secure gains. Thus, selling 70% of BTC holdings aligns with protecting gains and preparing for potential downturns, in light of mixed signals across momentum indicators.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,920.76 KRW