Bitcoin AI Trade Log – 2025 05 17 21:01:15

TIMESTAMP : 2025-05-17 21:01:15

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Bitcoin hitting $220K ‘reasonable’ in 2025, says gold-based forecast”(05/16/2025, 07:57 AM, +0000 UTC)

“Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend”(05/16/2025, 07:52 AM, +0000 UTC)

“Bitcoin bull flag and standard profit taking hint at eventual rally to new BTC price highs”(05/17/2025, 12:57 AM, +0000 UTC)

“Michael Saylor admits Strategy shareholders ‘would suffer’ if Bitcoin were to ‘fall 90% and stay there for 4 or 5 years'”(05/15/2025, 04:54 PM, +0000 UTC)

“DDC Enterprise Announces Bitcoin Reserve Strategy, Targets 5,000 BTC Within 36 Months”(05/15/2025, 09:04 PM, +0000 UTC)

Trading Log

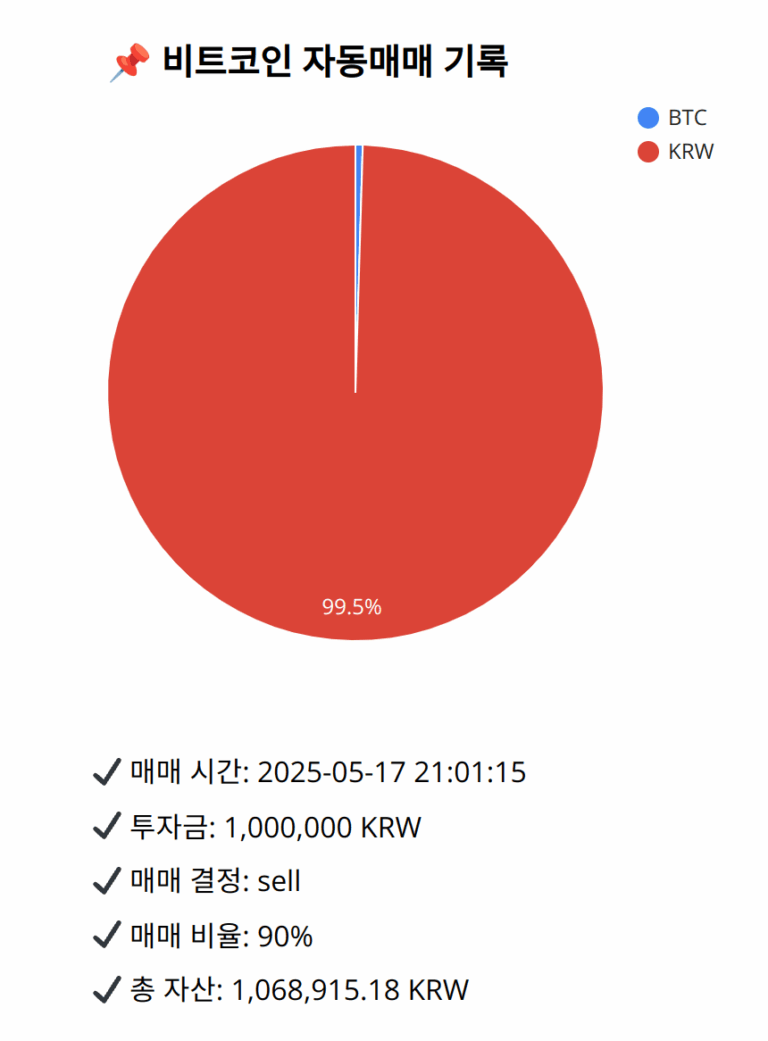

Investment amount: 1,000,000 KRW

BTC current price: 146259000.0 KRW

Reflection: Reflecting on the sequence of previous trades reveals a consistent strategic approach focusing on capital preservation amidst mixed momentum signals. Selling during signals of weakening momentum, especially defined by MACD indicators showing declines below the signal line, has been effective. Previous decisions that failed to adequately consider waning momentum led to unnecessary risks and missed opportunities to secure gains. Enhancement of decision timing around such technical confirmations as Bollinger Bands and RSI indicators has improved outcomes. Looking forward, maintaining vigilance when mixed signals arise, while ensuring responsive and adaptive strategies, will position the portfolio favorably to adjust to any bullish corrections without extensive risk exposure. This reflection implies that adherence to these principles ensures sustained portfolio health across varied market dynamics.

Decision: sell

Percentage: 90%

REASON: 1. Latest close price: 146259000

2. SMA values for 5, 20, 60, and 200 days: 146440800, 145921700, 144710283.3333333433, 135505315

3. RSI value: 54.3467913534

4. MACD value: 431258.6731478572

5. MACD signal value: 474116.9748288317

6. Bollinger Band: Middle (bb_bbm): 145907750, Upper (bb_bbh): 147415650.6149806976, Lower (bb_bbl): 144399849.3850193024

The latest close price is slightly above the 20-day SMA indicating some recent upward movement. However, the MACD value being below the signal line still suggests weakened momentum rather than a strong upward trend. The RSI is in a neutral range, neither supporting strong buy nor sell signals based on overbought or oversold conditions. The price is situated near the middle of the Bollinger Band, conveying limited upward pressure. Despite positive signals from the Fear and Greed Index showing ‘Greed’, technical indicators do not strongly support a robust upward movement. Recent reflections and analysis highlight a pattern of reducing exposure during such mixed momentum signals. Thus, selling 90% of the current BTC holding will protect the gains and hedge against possible downturns amidst unclear momentum signals. This decision adheres to a tested strategy of emphasizing capital preservation during periods of technical ambivalence.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,915.18 KRW