Bitcoin AI Trade Log – 2025 05 18 01:01:16

TIMESTAMP : 2025-05-18 01:01:16

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Is A Bitcoin Supercycle Imminent?”(05/16/2025, 01:11 PM, +0000 UTC)

“Price predictions 5/16: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, SUI, LINK, AVAX”(05/16/2025, 06:18 PM, +0000 UTC)

“Bitcoin bull flag and standard profit taking hint at eventual rally to new BTC price highs”(05/17/2025, 12:57 AM, +0000 UTC)

“Bitcoin Price Watch: Bearish Signals Emerge Despite Bullish Trendline”(05/17/2025, 11:30 AM, +0000 UTC)

Trading Log

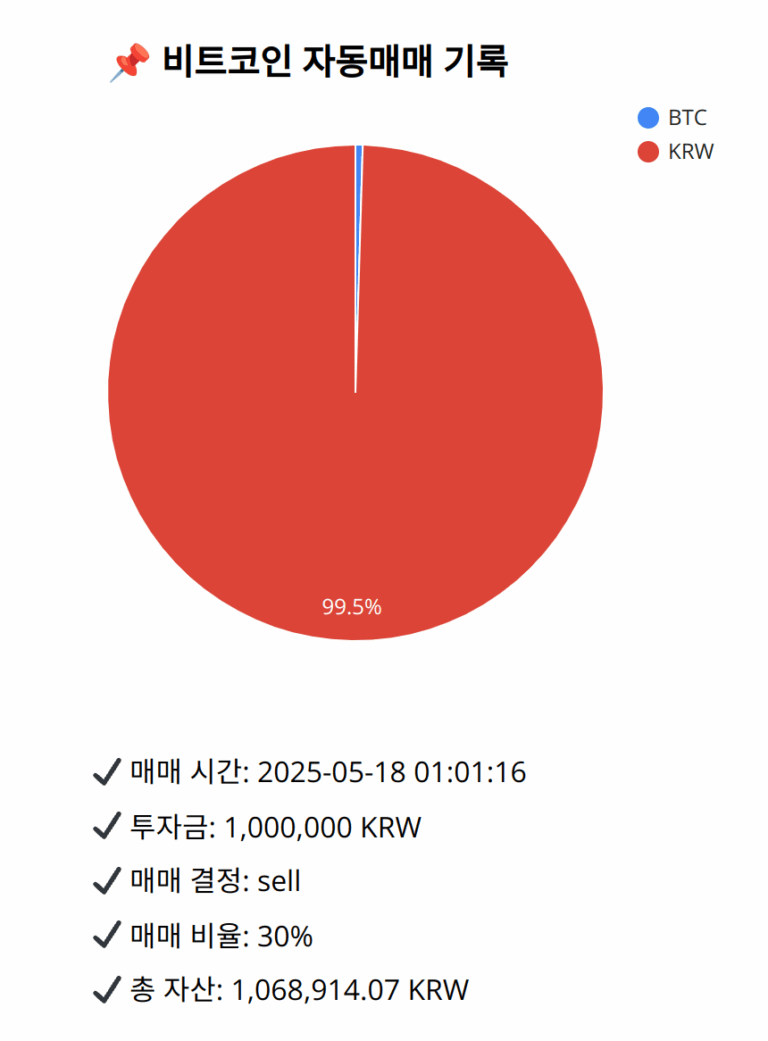

Investment amount: 1,000,000 KRW

BTC current price: 146227000.0 KRW

Reflection: Reflecting on the past 18 trades, the primary focus was on reducing exposure during signs of momentum weakening, particularly when the MACD showed potential bearish divergences. Success was often achieved by selling when technical indicators pointed towards potential resistance or consolidation, thus preserving gains and minimizing risk. However, there were challenges in precisely timing entries and exits during ambiguous trend periods. This suggested improvement should focus on closely monitoring supporting indicators like RSI and Bollinger Bands in combination with the primary moving averages. Applying these insights, I recommend a cautious reduction in holdings given the current technical setup, aligning with protective strategies amidst mixed signals from the indicators, effectively encapsulating a balanced approach between risk management and capital appreciation.

Decision: sell

Percentage: 30%

REASON: 1. Latest close price: 146270000

2. SMA values for 5, 20, 60, and 200 days: 146395600, 145951600, 144868166.67, 135621870

3. RSI value: 54.4210671007

4. MACD value: 397580.0654066205

5. MACD signal value: 458413.923428713

6. Bollinger Band: Middle (bb_bbm): 145951600, Upper (bb_bbh): 147445868.5702376068, Lower (bb_bbl): 144457331.4297623932

The latest close price is above the 20-day SMA, suggesting a potential uptrend. However, the MACD remains below the signal line, indicating weaker upward momentum. RSI is neutral, lacking strong up or downward signals. The price is near the middle Bollinger Band, indicating potential resistance without powerful upward momentum. Past reflections have highlighted success when acting on similar mixed signals, which favor reducing exposure strategically under such uncertain momentum conditions. Selling 30% aligns with steady portfolio adjustments to secure profits and reduce risk exposure, staying consistent with previous effective strategies.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,914.07 KRW