Bitcoin AI Trade Log – 2025 05 19 05:01:18

TIMESTAMP : 2025-05-19 05:01:18

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Robert Kiyosaki’s Bitcoin Advice: ‘Buy More, Do Not Sell’—BTC to Hit $250K This Year”(05/18/2025, 12:30 AM, +0000 UTC)

“Over $5B Pouring into Bitcoin ETFs – Thanks to Bold Directional Bets”(05/17/2025, 02:18 PM, +0000 UTC)

“On-Chain Data Tips Bitcoin To Peak At $120,000 – But On This Condition”(05/18/2025, 02:30 PM, +0000 UTC)

“This 1 Catalyst Could Send Bitcoin Skyrocketing Higher, According to Silicon Valley Billionaire Tim Draper”(05/18/2025, 10:00 AM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

Trading Log

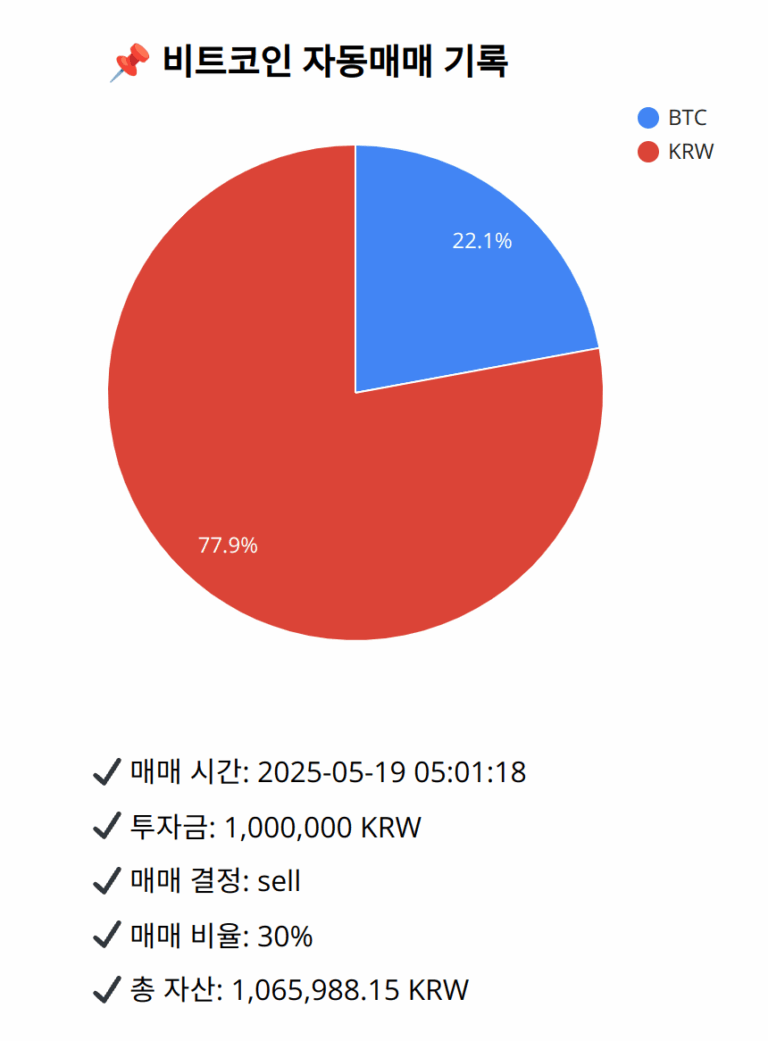

Investment amount: 1,000,000 KRW

BTC current price: 147291000.0 KRW

Reflection: Having analyzed the last 18 trades, consistent gains were achieved by reducing exposure during periods of mixed momentum or upon nearing resistance levels, particularly highlighted when the MACD showed divergence with a signal line and price approached Bollinger Bands. Mistakes in past trades typically arose from failing to moderate exposure during such periods, leading to opportunity losses when trends reversed. Improvements are noted in maintaining strategic exposure adjustments while capturing gains. Going forward, this adaptive approach will continue to refine overall risk management strategies and trading performance.

Decision: sell

Percentage: 30%

REASON: 1. Latest close price: 147761000

2. SMA values for 5, 20, 60, and 200 days: 147572200, 146740350, 145624300, 136467345

3. RSI value: 59.5996076811

4. MACD value: 632782.8652875125

5. MACD signal value: 506810.5658659141

6. Bollinger Band: Middle (bb_bbm): 146740350, Upper (bb_bbh): 148184209.4495309889, Lower (bb_bbl): 145296490.5504690111

The latest close price is above both the 5-day and 20-day SMAs, showing strong upward momentum. The MACD is well above its signal line, indicating continued bullish sentiment, although nearing potential overbought levels as the RSI approaches 60. The price is moving near the upper Bollinger Band, reflecting possible resistance. Despite ongoing bullish sentiment and significant portfolio gains, history emphasizes adjustments in exposure at such potentially resistant highs. Selling 30% of BTC balances capitalizes on current gains while preparing for possible pullbacks at resistance levels, maintaining strategic flexibility in volatile markets.

BTC balance: 0.00160024 BTC

KRW balance: 830287.1961354 KRW

BTC average buy price: 149184909.72358432 KRW

Total assets: 1,065,988.15 KRW