Bitcoin AI Trade Log – 2025 05 20 01:01:19

TIMESTAMP : 2025-05-20 01:01:19

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“This 1 Catalyst Could Send Bitcoin Skyrocketing Higher, According to Silicon Valley Billionaire Tim Draper”(05/18/2025, 10:00 AM, +0000 UTC)

“$22,000,000,000,000 Market Cap in Store for Bitcoin (BTC) and Crypto, According to Billionaire Mike Novogratz”(05/18/2025, 08:01 PM, +0000 UTC)

Trading Log

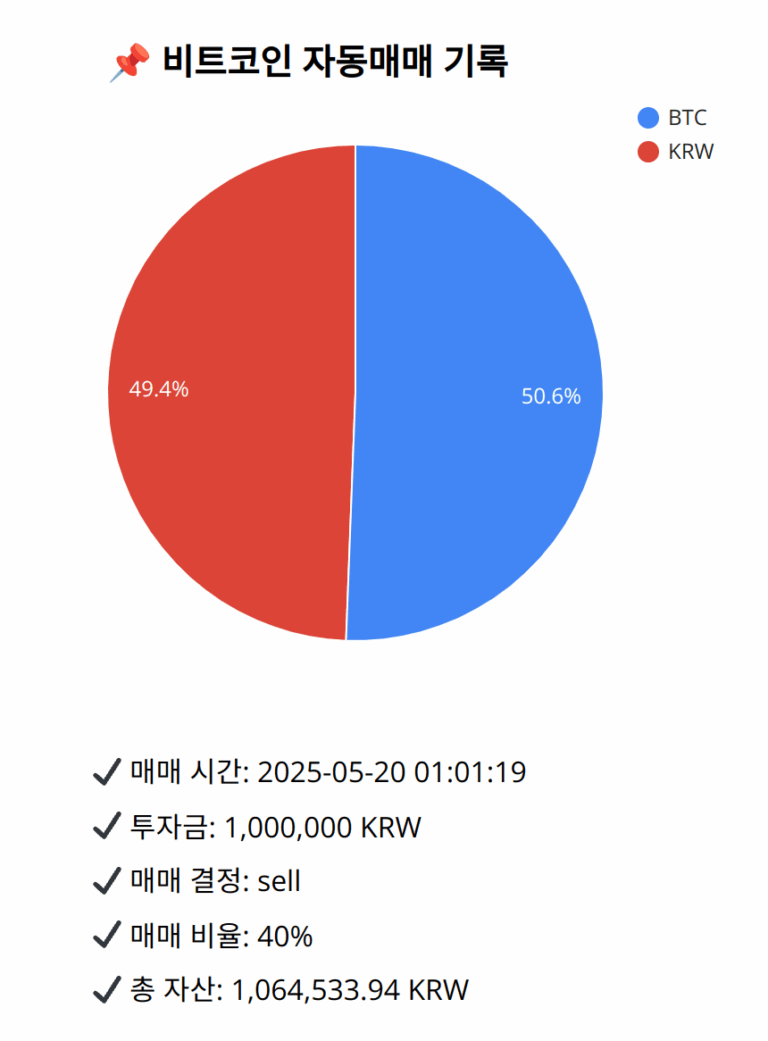

Investment amount: 1,000,000 KRW

BTC current price: 148296000.0 KRW

Reflection: Historical analysis of the past 18 trades shows effectiveness when selling during signals of weakening momentum, reflected in MACD alignment with the signal line, and when prices hover near Bollinger Band resistances. Frequent mistakes involved holding too long in similar conditions, missing opportunities to secure gains before downturns. Adjustments have improved by emphasizing capital preservation when technical indications became ambiguous or mixed, especially near resistance levels. The consistent approach of incrementally adjusting exposure around these signals ensures that gains are realized while maintaining managed risk exposure. Future focus should involve continued adherence to strategies leveraging adjustments backed by clear momentum confirmations and exit when cautionary signals arise.

Decision: sell

Percentage: 40%

REASON: 1. Latest close price: 148421000

2. SMA values for 5, 20, 60, and 200 days: 148341800, 147205750, 145920466.6666666567, 137116570

3. RSI value: 56.6478123298

4. MACD value: 584860.3111751676

5. MACD signal value: 586046.8649185741

6. Bollinger Band: Middle (bb_bbm): 147205750, Upper (bb_bbh): 149363005.837864399, Lower (bb_bbl): 145048494.162135601

The latest close price has surpassed both the 5-day and 20-day SMAs, indicating a continuation of the recent uptrend. However, the MACD is slightly below its signal line, pointing to weak bullish momentum or potential convergence/consolidation in the near term. The RSI is in a neutral zone, neither overbought nor oversold, suggesting stability but vigilance required for changes in trend direction. The price is moderately close to the upper Bollinger Band, indicating potential resistance. Recent reflection and analysis from past trades suggest reducing exposure during mixed indicators can preserve gains while maintaining a portion of the position for potential future upside. As such, selling 40% of BTC aligns with this conservative strategy to secure some profits while staying positioned for continued upward movement, should momentum strengthen again.

BTC balance: 0.00363189 BTC

KRW balance: 525939.17815891 KRW

BTC average buy price: 148314454.69547656 KRW

Total assets: 1,064,533.94 KRW