Bitcoin AI Trade Log – 2025 05 27 17:01:13

TIMESTAMP : 2025-05-27 17:01:13

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“‘Cataclysmic’ Fed U.S. Dollar ‘Crisis’ Warning Predicted To Spark ‘Parabolic’ Bitcoin Price Boom”(05/26/2025, 11:15 AM, +0000 UTC)

“BlackRock Issues Bitcoin Warning, Says BTC Source Code Could Be Rendered ‘Flawed or Ineffective’ by Quantum Computing”(05/26/2025, 06:06 PM, +0000 UTC)

“Bitcoin (BTC): $115,000 Next? 7,000,000,000 Pepe (PEPE) Long Is Born, Dogecoin (DOGE) Short-Term Rally Incoming?”(05/27/2025, 12:07 AM, +0000 UTC)

Trading Log

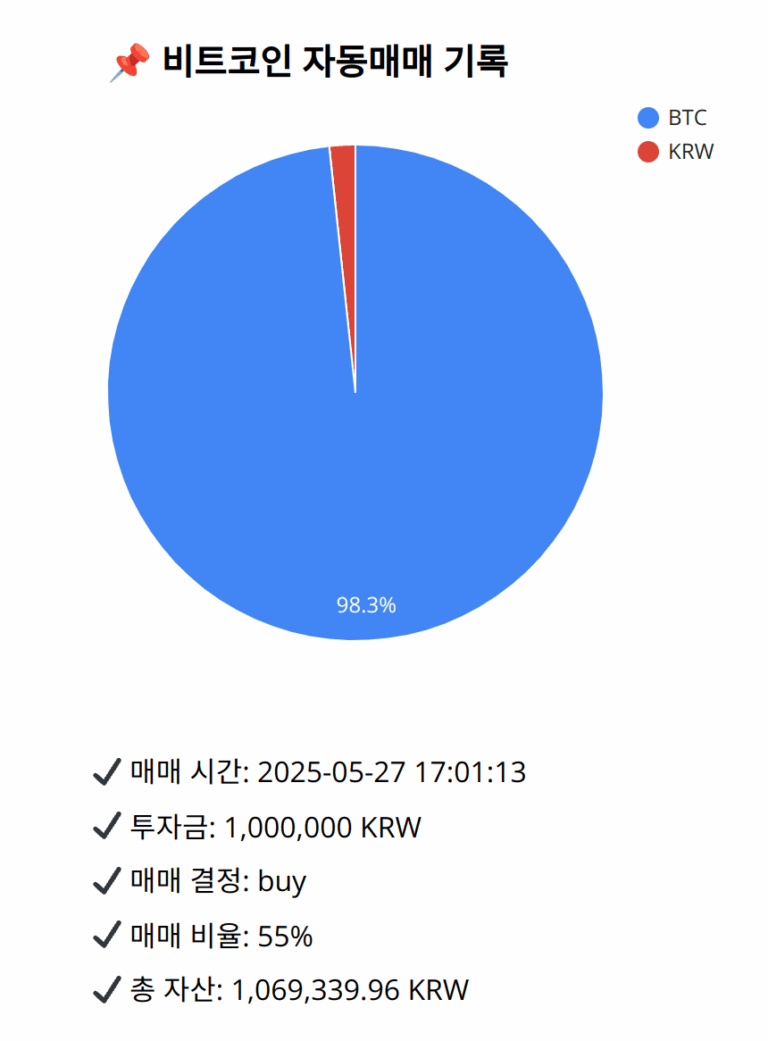

Investment amount: 1,000,000 KRW

BTC current price: 152193000.0 KRW

Reflection: Recent trades scaled in on golden cross and pullback signals, matching trend strength. The incremental approach has worked well, with no overtrading or missed signals. Position sizing has increased as the uptrend strengthened, which was correct. No major mistakes; signals were followed promptly. Continue to scale in more aggressively when both primary and secondary buy signals align in a strong bull market.

Decision: buy

Percentage: 55%

REASON: 1. Latest close price: 152193000

2. SMA values for 5, 20, 60, and 200 days: 151867800, 151566400, 150599667, 143101780

3. RSI value: 53.59

4. MACD value: 222064

5. MACD signal value: 218700

6. Bollinger Band: Middle (bb_bbm): 151566400, Upper (bb_bbh): 153149548, Lower (bb_bbl): 149983252

The latest close is above both the 5-day and 20-day SMAs, and the 5-SMA is above the 20-SMA, confirming the recent golden cross. The price has rebounded after a pullback to the 20-SMA, activating both primary (golden cross) and secondary (pullback in uptrend) buy signals. MACD is above its signal and rising, RSI is healthy and not overbought, and the price is near the upper Bollinger Band, showing strong bullish momentum. The long-term trend is bullish, with all major SMAs rising and price well above the 200-SMA. Given the strong uptrend, recent incremental buys, and continued confirmation of signals, increasing the allocation to 55% of available KRW is justified to further shift the portfolio toward BTC as the uptrend strengthens.

BTC balance: 0.00690773 BTC

KRW balance: 18031.804403 KRW

BTC average buy price: 152023917.79117498 KRW

Total assets: 1,069,339.96 KRW