Bitcoin AI Trade Log – 2025 05 12 05:01:17

TIMESTAMP : 2025-05-12 05:01:17

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Crypto Suddenly Braced For A Huge China Earthquake As $1 Million Bitcoin Price Predicted To Flip Gold”(05/10/2025, 10:40 AM, +0000 UTC)

“Standard Chartered analyst apologizes for $120,000 bitcoin price call, says target ‘may be too low'”(05/08/2025, 01:10 PM, +0000 UTC)

“Bitcoin now deflationary due to Strategy’s BTC purchases — Analyst”(05/10/2025, 06:02 PM, +0000 UTC)

“Strategy’s Saylor Teases New Bitcoin Purchases as BTC Price Approaches New ATH”(05/11/2025, 06:54 PM, +0000 UTC)

Trading Log

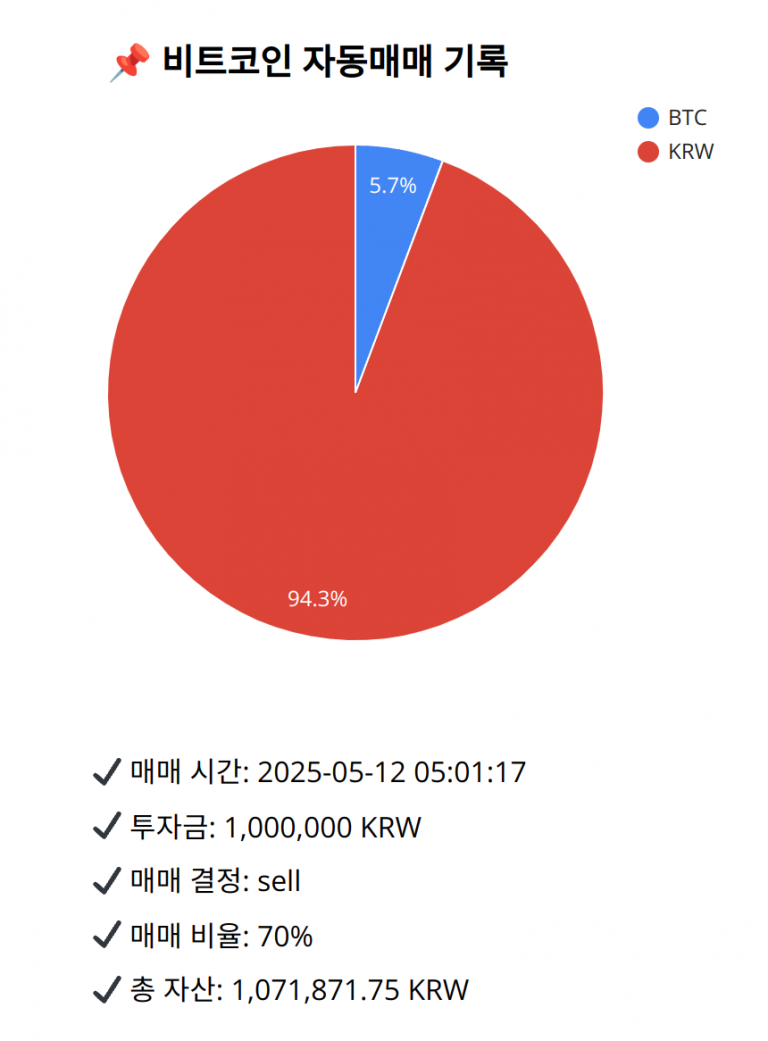

Investment amount: 1,000,000 KRW

BTC current price: 145608000.0 KRW

Reflection: Upon reviewing the past 18 trades with the current market scenario, maintaining a balance between secure gains and strategizing for future market movements is critical. The effective approach from past trades has been to capitalize on highs and reduce exposure during potential reversals, as seen in current divergences in MACD and RSI’s elevated condition. While past strategies have been successful by using key signals like golden crosses, dynamic adaptation to weakening indicators, such as MACD’s current crossover below its signal, guides precautionary steps. The decision aligns with both protecting gains and realigning cash allocations for capturing future buy signals in prolonged uptrends.

Decision: sell

Percentage: 70%

REASON: 1. Latest close price: 145680000

2. SMA values for 5, 20, 60, and 200 days: 145231800, 144564250, 139531216.6666666567, 131152875

3. RSI value: 65.4431297156

4. MACD value: 1600726.0325664282

5. MACD signal value: 1712827.199444884

6. Bollinger Band: Middle (bb_bbm): 144564250, Upper (bb_bbh): 146217992.7702026069, Lower (bb_bbl): 142910507.2297973931

The recent data shows the 5-day SMA is above the 20-day SMA indicating a golden cross. However, the MACD is below its signal line, showing a potential bearish divergence, and RSI is slightly high, indicating potential for a pullback. The price is near the Bollinger Band’s upper limit. Alongside prior reflections emphasizing capitalizing gains in such situations, selling 70% of BTC to secure profits and reposition cash aligns with a cautious approach amid mixed signals, especially as signs suggest potential temporary reversals.

BTC balance: 0.00042184 BTC

KRW balance: 1010448.47538792 KRW

BTC average buy price: 144434262.92135704 KRW

Total assets: 1,071,871.75 KRW