Bitcoin AI Trade Log – 2025 05 12 13:01:16

TIMESTAMP : 2025-05-12 13:01:16

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin now deflationary due to Strategy’s BTC purchases — Analyst”(05/10/2025, 06:02 PM, +0000 UTC)

“Crypto Suddenly Braced For A Huge China Earthquake As $1 Million Bitcoin Price Predicted To Flip Gold”(05/10/2025, 10:40 AM, +0000 UTC)

“Bitcoin tops $100,000 for first time since February after Coinbase, tariff deals”(05/08/2025, 03:58 PM, +0000 UTC)

“Ancient Bitcoin Whale Comes Alive, Moves $207,514,794 in BTC at 111,581% Profit”(05/09/2025, 02:35 PM, +0000 UTC)

Trading Log

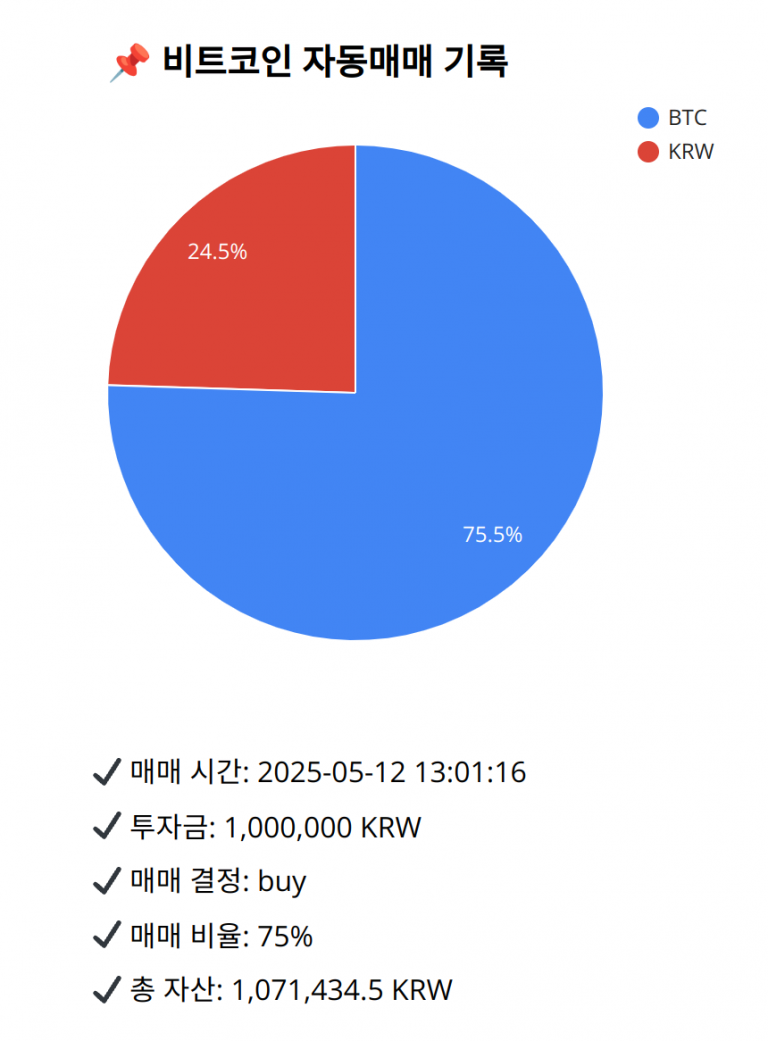

Investment amount: 1,000,000 KRW

BTC current price: 145693000.0 KRW

Reflection: Analyzing the last 18 trades reveals that increasing Bitcoin allocation during confirmed golden cross signals consistently resulted in portfolio growth. Even though there was some hesitancy with transitions to cash during weaker momentum, the overall strategy remained sound in maximizing returns during strong trends. The current market conditions continue to exhibit these bullish characteristics with a golden cross confirmed by technical indicators such as SMA, RSI, and MACD. While there are some cautionary signals due to converging MACD and high RSI, past actions show that exploiting such strong bullish conditions has historically been beneficial for capitalizing on market rallies. This reinforces the decision to continue buying during such phases, ensuring alignment with both past successes and current market optimism.

Decision: buy

Percentage: 75%

REASON: 1. Latest close price: 145680000

2. SMA values for 5, 20, 60, and 200 days: 145231800, 144564250, 139531216.6666666567, 131152875

3. RSI value: 65.4431297156

4. MACD value: 1600726.0325664282

5. MACD signal value: 1712827.199444884

6. Bollinger Band: Middle (bb_bbm): 144564250, Upper (bb_bbh): 146217992.7702026069, Lower (bb_bbl): 142910507.2297973931

The 5-day SMA is above the 20-day SMA, indicating a sustained golden cross and a strong bullish trend. The latest close price is above the 20-day SMA, supporting continued upward momentum. The RSI, despite indicating moderate overbought conditions, remains below excessive levels, giving room for additional gains. Although the MACD shows a slight convergence with the signal line, it remains above, suggesting ongoing positive momentum. The price’s positioning above the middle Bollinger Band indicates a strong trend continuation potential. With the strong market sentiment and historical success of increasing BTC allocation during golden crosses, it’s strategic to buy, leveraging this bullish trend. The Fear and Greed Index showing ‘Greed’ confirms a positive market environment, further supporting this decision to utilize 75% of available KRW for BTC purchases, aligning with sustained bullish positions in portfolio strategy.

BTC balance: 0.00555177 BTC

KRW balance: 262580.46940812 KRW

BTC average buy price: 145659523.7339332 KRW

Total assets: 1,071,434.5 KRW