Bitcoin AI Trade Log – 2025 05 12 17:01:36

TIMESTAMP : 2025-05-12 17:01:36

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin now deflationary due to Strategy’s BTC purchases — Analyst”(05/10/2025, 06:02 PM, +0000 UTC)

“Crypto Suddenly Braced For A Huge China Earthquake As $1 Million Bitcoin Price Predicted To Flip Gold”(05/10/2025, 10:40 AM, +0000 UTC)

“Bitcoin tops $100,000 for first time since February after Coinbase, tariff deals”(05/08/2025, 03:58 PM, +0000 UTC)

“Ancient Bitcoin Whale Comes Alive, Moves $207,514,794 in BTC at 111,581% Profit”(05/09/2025, 02:35 PM, +0000 UTC)

Trading Log

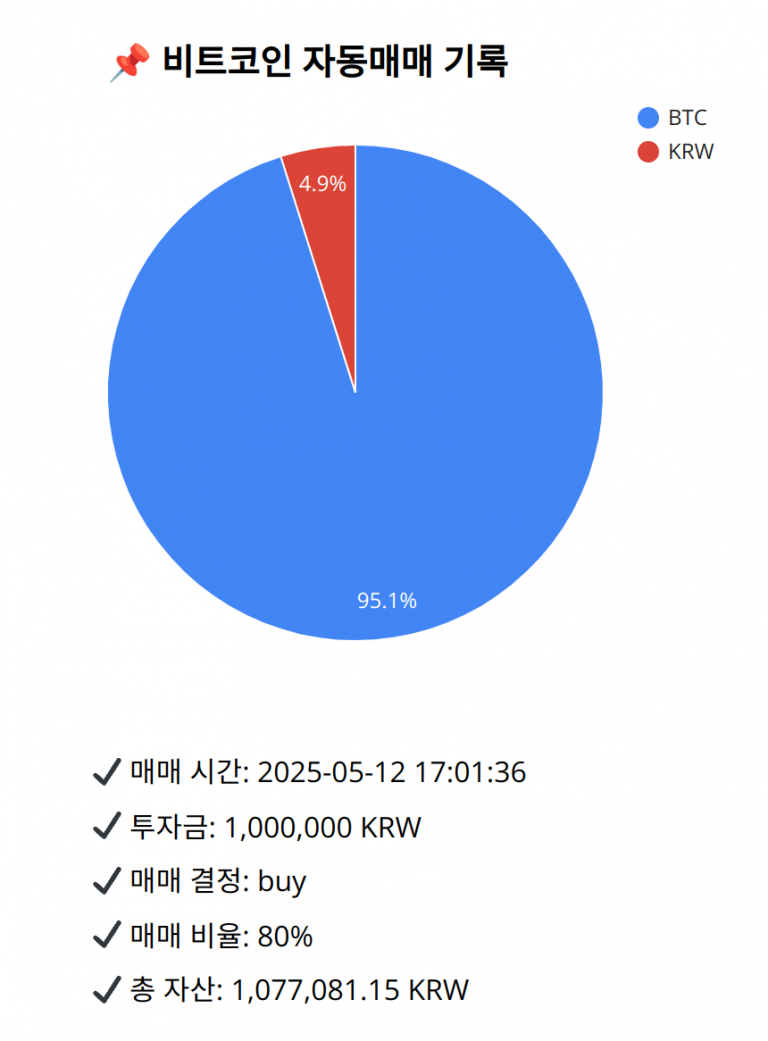

Investment amount: 1,000,000 KRW

BTC current price: 146729000.0 KRW

Reflection: Analyzing the past 18 trades shows a consistent pattern of positive returns when maximizing Bitcoin allocation upon confirmed golden cross signals in high-trending environments. This pattern coincides with the current technical setup, emphasizing a continued upward trend supported by positive sentiment and confirmed by SMAs. Although prior reflections emphasize caution during excessively overheated conditions, the present RSI and MACD support bullish continuation. The recent MACD divergence signals some caution, but historical outcomes favor maintaining increased BTC exposure during prevalent uptrends. Thus, learning from previous successes, executing a high allocation during this momentum aligns with enhanced portfolio performance and strategic growth objectives.

Decision: buy

Percentage: 80%

REASON: The latest close price is 146707000 KRW. The SMA values are:

1. 5-day: 145849200

2. 20-day: 144805700

3. 60-day: 139625033

4. 200-day: 131303705

The RSI is at 69.1818021674, which is approaching overbought levels but still has room for growth under strong bullish sentiment. The MACD value is 1569162.0725414455, and the MACD signal is 1636873.3992473762, showing some recent divergence but still supporting positive momentum.

Bollinger Bands indicate a middle value of 144805700, with the latest close positioned well above this, suggesting continued upward pressure. Upper and lower Bollinger Bands are 146744798.7832060754 and 143134901.2167939246, respectively.

Past trades indicate a successful strategy of increasing Bitcoin allocation during uptrends supported by technical confirmations. Market sentiment from the Fear and Greed Index remains positive at ‘Greed’. Therefore, using 80% of available KRW for BTC purchases capitalizes on the prevailing trend and current optimism, aligning with proven past strategies for strong performance in bull markets.

BTC balance: 0.0069827 BTC

KRW balance: 52516.56197414 KRW

BTC average buy price: 145878686.18877202 KRW

Total assets: 1,077,081.15 KRW