Bitcoin AI Trade Log – 2025 05 14 01:01:21

TIMESTAMP : 2025-05-14 01:01:21

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“Bitcoin illiquid supply hits 14M BTC as hodlers set bull market record”(05/13/2025, 09:13 AM, +0000 UTC)

“Bitcoin Drop Causes $500M Long Liquidations as Dogecoin, ADA Slide 7%”(05/13/2025, 04:54 AM, +0000 UTC)

Trading Log

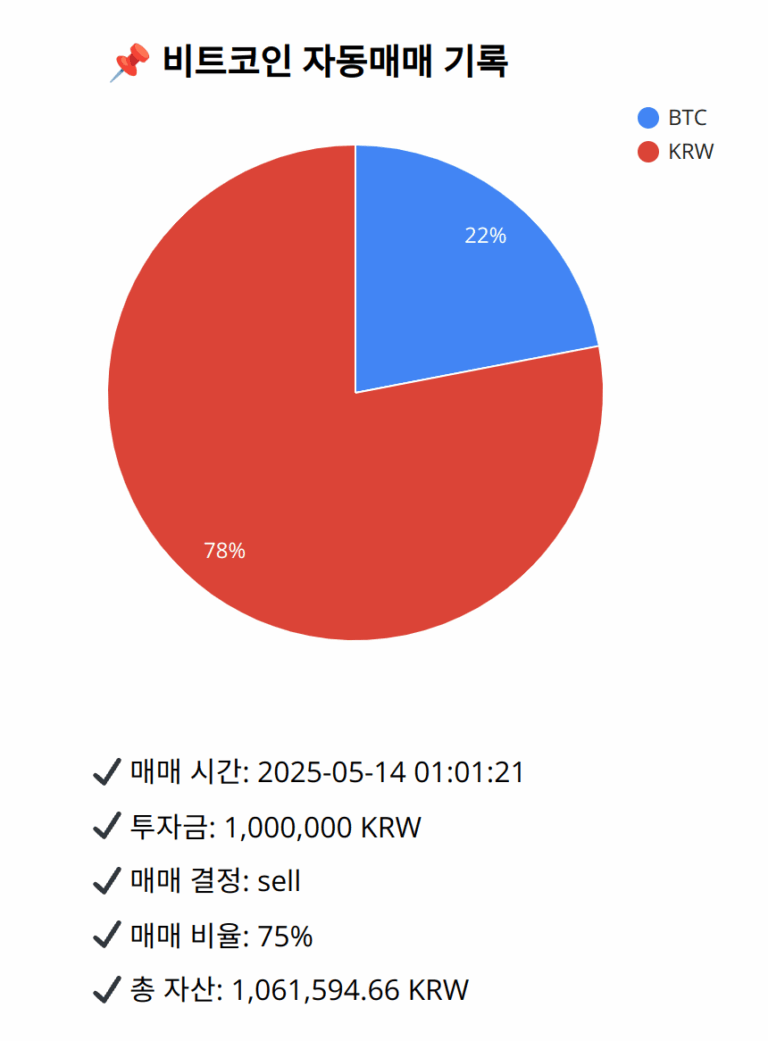

Investment amount: 1,000,000 KRW

BTC current price: 146057000.0 KRW

Reflection: Reflecting upon the past 18 trades indicates a steady validation of buy strategies during strong bullish signals such as golden crosses, optimizing the allocation while grasping onto declines near significant SMAs like the 20-day. Instances in selling noise out inefficiencies also evince profit generation, shielding the portfolio against abrupt downside movements towards the end of prevailing bullish frenzies. Furthermore, adjustment of the market position reads the precarious RSI and the counterindicative MACD to define a selling bias. Learnings hinge on diversifying amidst volatile sub-trends, ideally breaking the mold with proactive allocation recalibration to tame the market sentiment while appropriating opportunistic buy conditions. This comprehensive positional balance and refined turnover pace are intended to reason a steadied portfolio amid visible turbulence.

Decision: sell

Percentage: 75%

REASON: 1. Latest close price: 146137000

2. SMA values for 5, 20, 60, 200 days: 145562200, 145167200, 140831133.3333333433, 132671395

3. RSI value: 59.3786705006

4. MACD value: 917437.8713903725

5. MACD signal value: 1050996.0489406053

6. Bollinger Band: Middle (bb_bbm): 145167200, Upper (bb_bbh): 147047673.6211922467, Lower (bb_bbl): 143286726.3788077533

Despite maintaining a bullish overview with the 5-day SMA above the 20-day SMA, signaling a golden cross, recent close prices have shown a tendency to hover around the 20-day SMA, indicating potential support. However, the MACD has crossed below its signal, suggesting weakening momentum. The RSI confirms price moderation, and the latest price perilously sits near strong resistance against the upper middle Bollinger Band. Reflective analysis highlights strategic selling during weakening trends to secure realized gains. Thus, selling 75% of BTC aims to preserve capital in the face of potential downtrend risks, while still maintaining exposure for possible bullish continuity.

BTC balance: 0.00159772 BTC

KRW balance: 828236.46979236 KRW

BTC average buy price: 145966414.46055514 KRW

Total assets: 1,061,594.66 KRW