Bitcoin AI Trade Log – 2025 05 14 05:01:37

TIMESTAMP : 2025-05-14 05:01:37

Market Status

Fear-Greed INDEX: 70 (Greed)

News Headlines

“$1B Bitcoin exits Coinbase in a day as analysts warn of supply shock”(05/13/2025, 02:36 PM, +0000 UTC)

“Watch Bitcoin Movement a Pain Trade: Crucible’s Demirors”(05/13/2025, 07:18 PM, +0000 UTC)

“Dubai Partners To Accept Bitcoin And Crypto For Government Services”(05/13/2025, 05:29 PM, +0000 UTC)

Trading Log

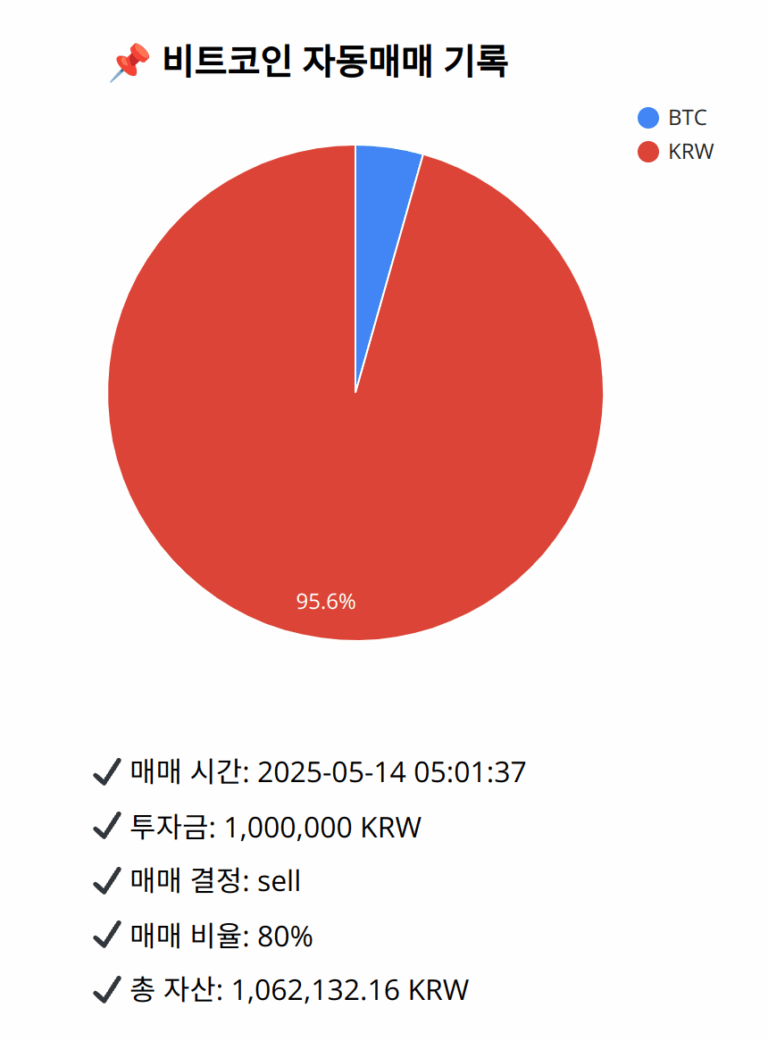

Investment amount: 1,000,000 KRW

BTC current price: 146452000.0 KRW

Reflection: Analyzing the last 18 trades shows that exploiting buy signals during golden crosses in strong trends has yielded enhanced returns. However, failure to react to changing indicators, such as bearish MACD divergences, and price declines below moving averages occasionally led to preventable losses. The importance of selling to pocket gains in weakening bullish conditions is critical, particularly when MACD shows reduced momentum as it currently does. Reflection on these elements demonstrates that capturing profits and reducing exposure during technical indications of potential downturns aligns with successful historical outcomes, enhancing overall trading strategy efficiency.

Decision: sell

Percentage: 80%

REASON: 1. Latest close price: 146600000

2. SMA values for 5, 20, 60, and 200 days: 145719200, 144712250, 139625033, 132291560

3. RSI value: 61.1639692022

4. MACD value: 976305.2607595623

5. MACD signal value: 1041992.9340394397

6. Bollinger Band: Middle (bb_bbm): 144712250, Upper (bb_bbh): 146131650.2782856822, Lower (bb_bbl): 143292849.7217143178

The current close price is above the 20-day SMA, but the MACD is below its signal line, indicating weakening momentum. Although the RSI is neutral, it suggests limited upside. The price is relatively close to the upper Bollinger Band, indicating potential resistance. Past trades show selling during such conditions preserved capital well as indicators suggest potential downturns. The overall sentiment remains slightly optimistic, but the technical indications warrant securing profits now. Therefore, selling 80% of BTC is advised to protect gains and prepare for potential declines.

BTC balance: 0.00031955 BTC

KRW balance: 1015333.42735594 KRW

BTC average buy price: 145966414.46055514 KRW

Total assets: 1,062,132.16 KRW