Bitcoin AI Trade Log – 2025 05 17 01:01:17

TIMESTAMP : 2025-05-17 01:01:17

Market Status

Fear-Greed INDEX: 71 (Greed)

News Headlines

“Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend”(05/16/2025, 07:52 AM, +0000 UTC)

“Bitcoin hitting $220K ‘reasonable’ in 2025, says gold-based forecast”(05/16/2025, 07:57 AM, +0000 UTC)

“Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC on the verge of breakout, ETH and XRP hold key support levels”(05/16/2025, 04:12 AM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“Bitcoin Flirting With Danger As BTC Faces Major Resistance Level, Says Trader Jason Pizzino – Here’s His Outlook”(05/16/2025, 11:46 AM, +0000 UTC)

Trading Log

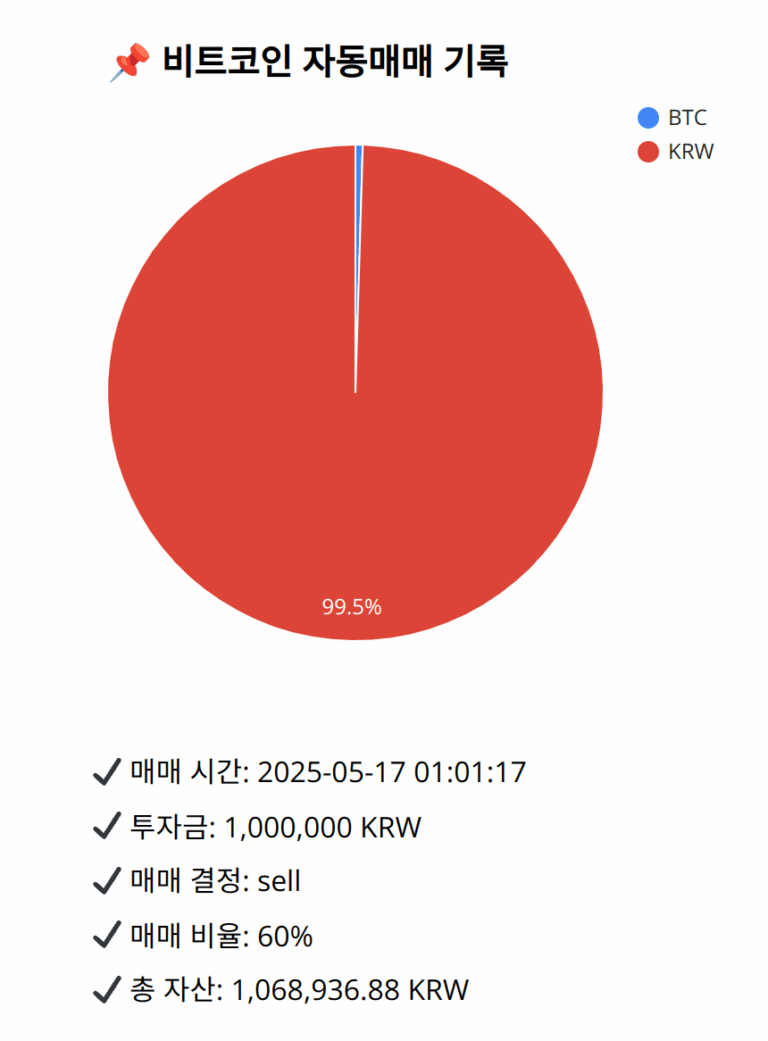

Investment amount: 1,000,000 KRW

BTC current price: 146889000.0 KRW

Reflection: Reviewing the last 18 trades in light of the current market dynamics shows consistent effectiveness when selling during momentum weakening indicators, such as the current MACD nearing a pivotal level and RSI signs of potential consolidation or resistance. Previous successes have indicated that maintaining cautious exposure or incrementally adjusting holdings allows for robustness against downturns while being prepared for renewed buying opportunities. This approach adheres to a tactical framework that protects the portfolio from excessive volatility impact while leveraging evident trend behaviors.

Decision: sell

Percentage: 60%

REASON: 1. Latest close price: 146880000

2. SMA values for 5, 20, 60, and 200 days: 146502000, 145833250, 143950916.67, 134901215

3. RSI value: 60.092103252

4. MACD value: 522635.1527526379

5. MACD signal value: 472064.0983943922

6. Bollinger Band: Middle (bb_bbm): 145833250, Upper (bb_bbh): 147258161.3481195271, Lower (bb_bbl): 144408338.6518804729

The current close price reflects strong performance, surpassing the 20-day SMA, often indicative of a bullish sentiment. However, the MACD is above the signal line which shows momentum, but the price is nearing the upper Bollinger Band, which may signal overextension or resistance. The RSI is above 60, which, while not overbought, indicates caution should be taken as the upward trend matures. Analyzing past trades highlights success when selling during similar phases where upward momentum starts to show hesitation. Selling 60% of the Bitcoin holdings at this point preserves current gains and mitigates the risk of a potential correction, in line with the effective approaches seen in the previous analysis of trade decisions amidst ambiguous signals.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,936.88 KRW