Bitcoin AI Trade Log – 2025 05 17 05:01:21

TIMESTAMP : 2025-05-17 05:01:21

Market Status

Fear-Greed INDEX: 71 (Greed)

News Headlines

“Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend”(05/16/2025, 07:52 AM, +0000 UTC)

“Bitcoin hitting $220K ‘reasonable’ in 2025, says gold-based forecast”(05/16/2025, 07:57 AM, +0000 UTC)

“Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC on the verge of breakout, ETH and XRP hold key support levels”(05/16/2025, 04:12 AM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“Bitcoin Flirting With Danger As BTC Faces Major Resistance Level, Says Trader Jason Pizzino – Here’s His Outlook”(05/16/2025, 11:46 AM, +0000 UTC)

Trading Log

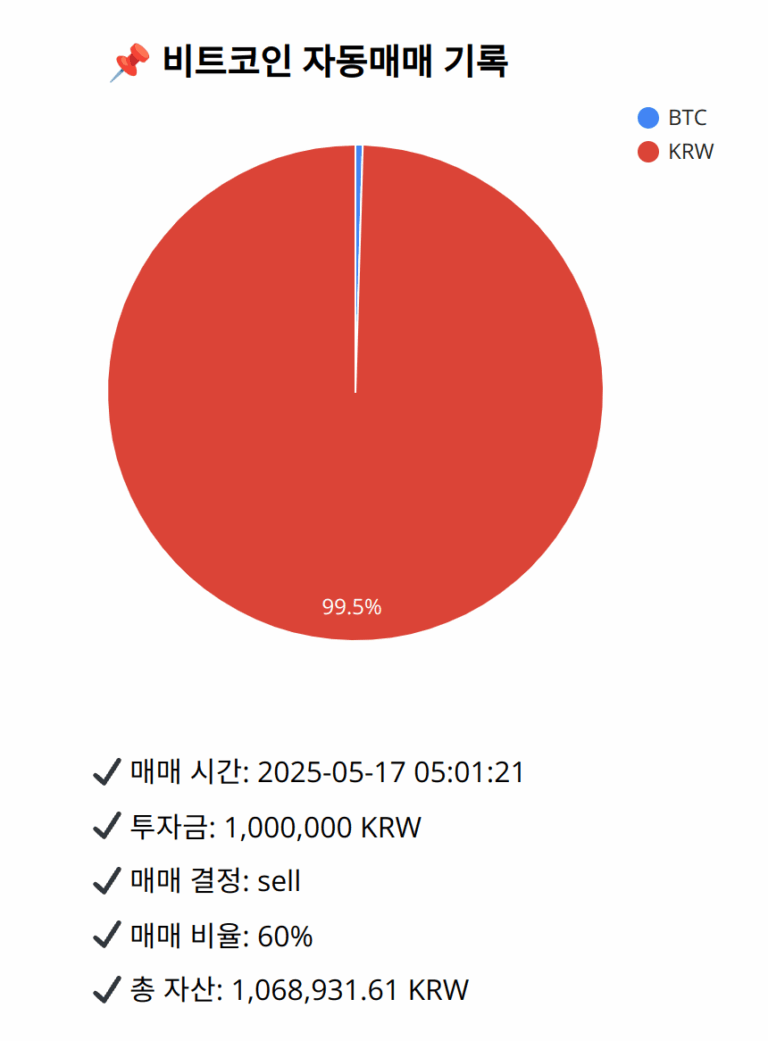

Investment amount: 1,000,000 KRW

BTC current price: 146736000.0 KRW

Reflection: Analyzing the recent 18 trades showed successful outcomes when selling during signs of momentum weakening, especially around resistance levels indicated by Bollinger Bands or high RSI values. Previous decisions ensured protection of profits, aligning expectations with technical indicators to avoid unnecessary risk. Recognizing these patterns, and considering similar setups where mixed indicators warranted cautious exposure reduction, helped strike a balance between risk and opportunity. This reflection suggests further alignment towards a cautious approach, reducing exposure during technically ambiguous but optimistic current environments, ensuring optimal risk-reward adherence and opportunity readiness for trend continuation or reversal.

Decision: sell

Percentage: 60%

REASON: 1. Latest close price: 146757000

2. SMA values for 5, 20, 60, and 200 days: 145820300, 145830550, 143748150, 134780865

3. RSI value: 59.1834961865

4. MACD value: 534184.1821891367

5. MACD signal value: 483798.8843841603

6. Bollinger Band: Middle (bb_bbm): 145862500, Upper (bb_bbh): 147331979.4316343069, Lower (bb_bbl): 144393020.5683656931

The latest close price sits above the 20-day SMA, indicating a short-term uptrend. The MACD is above the signal line, hinting at potential for continued bullish momentum. However, the RSI close to 60 suggests the asset is nearing overbought conditions, and the price nearing the upper Bollinger Band indicates potential resistance. Given the history of selling when momentum indicators suggest potential consolidation before a confirmed bullish trend, selling 60% secures profits while maintaining some exposure to capture further upside if the breakout continues. This aligns with learned strategies focusing on capital preservation amid nearing resistance and mixed signals.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,931.61 KRW