Bitcoin AI Trade Log – 2025 05 17 13:01:12

TIMESTAMP : 2025-05-17 13:01:12

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend”(05/16/2025, 07:52 AM, +0000 UTC)

“Bitcoin hitting $220K ‘reasonable’ in 2025, says gold-based forecast”(05/16/2025, 07:57 AM, +0000 UTC)

“DDC Enterprise Announces Bitcoin Reserve Strategy, Targets 5,000 BTC Within 36 Months”(05/15/2025, 09:04 PM, +0000 UTC)

Trading Log

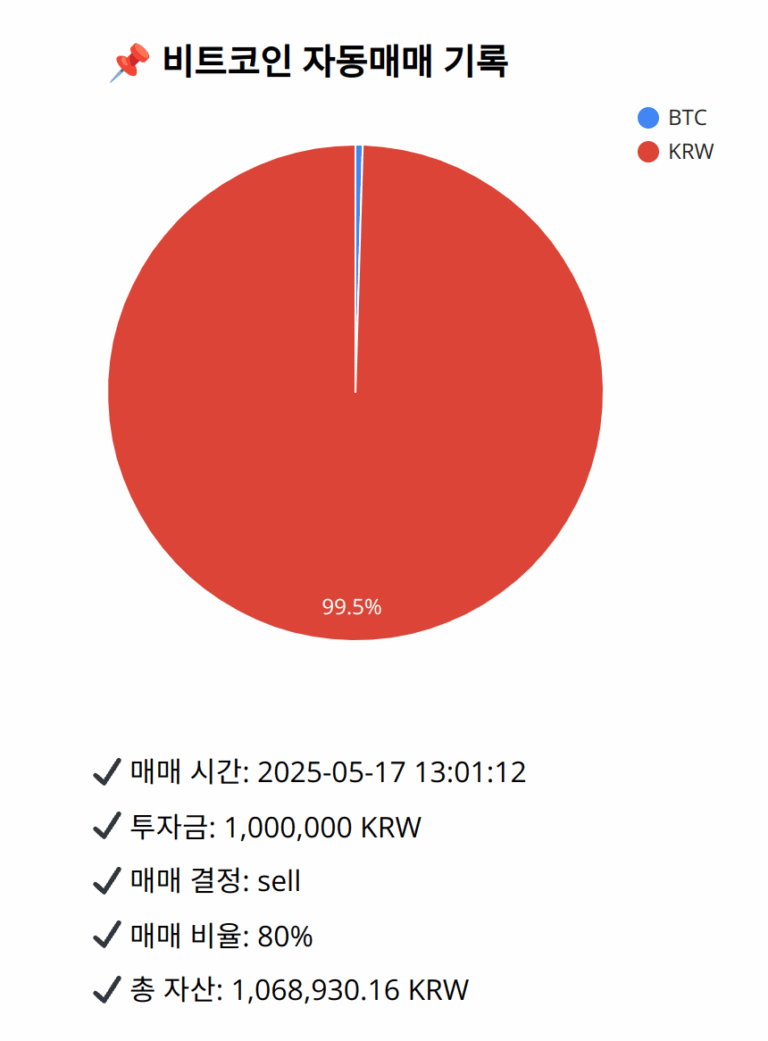

Investment amount: 1,000,000 KRW

BTC current price: 146694000.0 KRW

Reflection: Analysis of the past 18 trades alongside the latest data underscores selling during mixed indicators has effectively preserved gains. Past effectiveness of reducing exposure when momentum shows possible waiting resistance (e.g., highlighting when price approaches upper Bollinger Band) has enabled protection against downturns. Although BTC holds some bullish sentiment, potential resistance necessitates consolidation of any profits, balancing towards safety with market vulnerabilities. Future trading should continue leveraging reflective insights while maintaining flexibility amid fast-evolving indicators.

Decision: sell

Percentage: 80%

REASON: 1. Latest close price: 146694000

2. SMA values for 5, 20, 60, and 200 days: 146674800, 145888750, 144419700, 135271585

3. RSI value: 58.2378075948

4. MACD value: 511316.8138607442

5. MACD signal value: 490578.72193254

6. Bollinger Band: Middle (bb_bbm): 145888750, Upper (bb_bbh): 147374783.3609983325, Lower (bb_bbl): 144402716.6390016675

The latest close price exceeds the 5-day SMA, indicating short-term bullishness, but the MACD value, while above the signal, is nearing resistance with potential diminishing returns. The RSI remains neutral below overbought levels, suggesting not much short-term pressure for upside. The price is close to the upper Bollinger Band, reflecting potential resistance. Past analysis and strategies suggest secure gains during similar scenarios, and recent successful strategies involved selling during indications of mixed strength. Hence, selling 80% of BTC aligns with protecting gains against potential corrective price action while keeping risk managed.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,930.16 KRW