Bitcoin AI Trade Log – 2025 05 17 17:01:13

TIMESTAMP : 2025-05-17 17:01:13

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Bitcoin hitting $220K ‘reasonable’ in 2025, says gold-based forecast”(05/16/2025, 07:57 AM, +0000 UTC)

“Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend”(05/16/2025, 07:52 AM, +0000 UTC)

“Bitcoin bull flag and standard profit taking hint at eventual rally to new BTC price highs”(05/17/2025, 12:57 AM, +0000 UTC)

“Michael Saylor admits Strategy shareholders ‘would suffer’ if Bitcoin were to ‘fall 90% and stay there for 4 or 5 years'”(05/15/2025, 04:54 PM, +0000 UTC)

“DDC Enterprise Announces Bitcoin Reserve Strategy, Targets 5,000 BTC Within 36 Months”(05/15/2025, 09:04 PM, +0000 UTC)

Trading Log

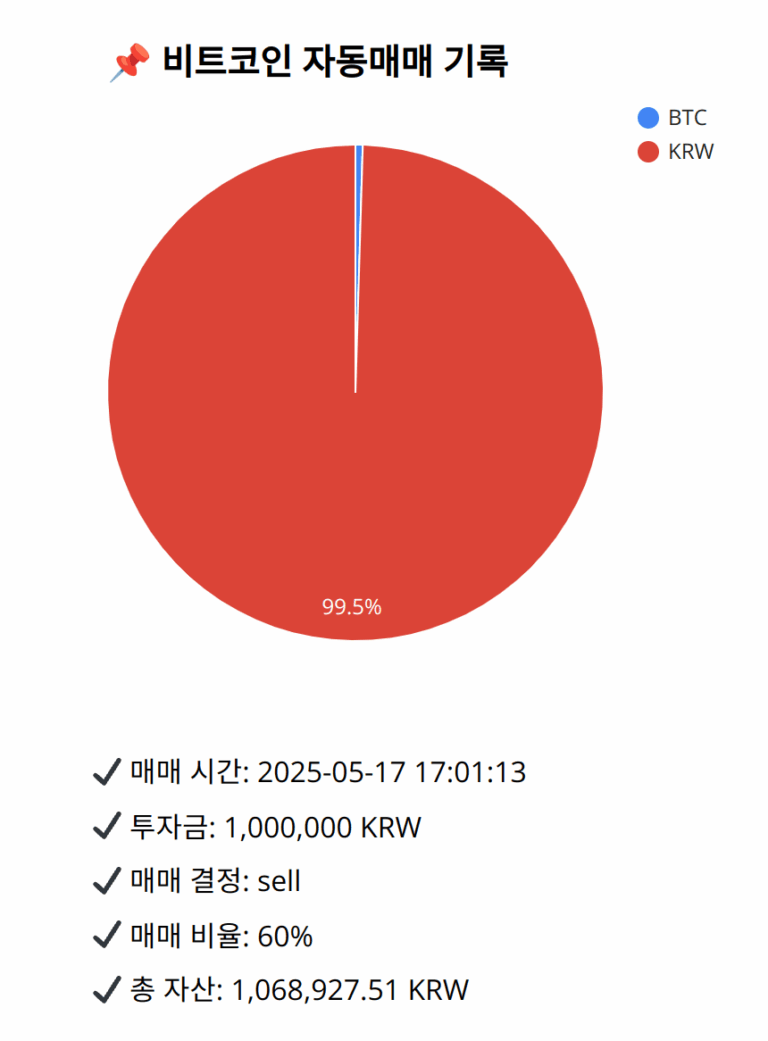

Investment amount: 1,000,000 KRW

BTC current price: 146617000.0 KRW

Reflection: Reflecting on the past 18 trades, aligning decisions with technical indications, especially around mixed momentum signals, has consistently preserved gains. The MACD reflects ongoing positive momentum, but other indicators such as the nearing of the upper Bollinger Band and RSI levels suggest potential caution due to approaching resistance. Previous errors included not adequately reacting to such resistance signals, stressing the importance of remaining vigilant against overly bullish sentiment without strong technical support. Improving the timing and quantity of exiting strategies during these periods constitutes a refinement seen in past successful trades. Hence, this decision to sell aligns with a strategy focused on capital preservation amidst technical caution.

Decision: sell

Percentage: 60%

REASON: 1. Latest close price: 146617000

2. SMA values for 5, 20, 60, and 200 days: 146626000, 145925650, 144571616.6666666567, 135389395

3. RSI value: 57.7214425665

4. MACD value: 495315.22818771

5. MACD signal value: 490543.2311607592

6. Bollinger Band: Middle (bb_bbm): 145925650, Upper (bb_bbh): 147436873.7789288461, Lower (bb_bbl): 144414426.2210711539

The latest close price reflects a move above both the 20-day SMA and near the upper Bollinger Band, indicating potential resistance. Although the MACD is above its signal line, suggesting persistent momentum, combined with the RSI nearing the higher end of the scale, caution is advised. Despite the potential for continued upward momentum, the previous strategy to sell during signals of mixed momentum has been effective. Thus, selling 60% of BTC aligns with protecting profits amidst indications of possible resistance and potential price consolidation in line with historical decisions highlighting similar technical setups.

BTC balance: 3.445e-05 BTC

KRW balance: 1063876.5529091 KRW

BTC average buy price: 144467296.39102498 KRW

Total assets: 1,068,927.51 KRW