Bitcoin AI Trade Log – 2025 05 18 17:01:13

TIMESTAMP : 2025-05-18 17:01:13

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Over $5B Pouring into Bitcoin ETFs – Thanks to Bold Directional Bets”(05/17/2025, 02:18 PM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“Is A Bitcoin Supercycle Imminent?”(05/16/2025, 01:11 PM, +0000 UTC)

“Michael Saylor admits Strategy shareholders ‘would suffer’ if Bitcoin were to ‘fall 90% and stay there for 4 or 5 years'”(05/15/2025, 04:54 PM, +0000 UTC)

Trading Log

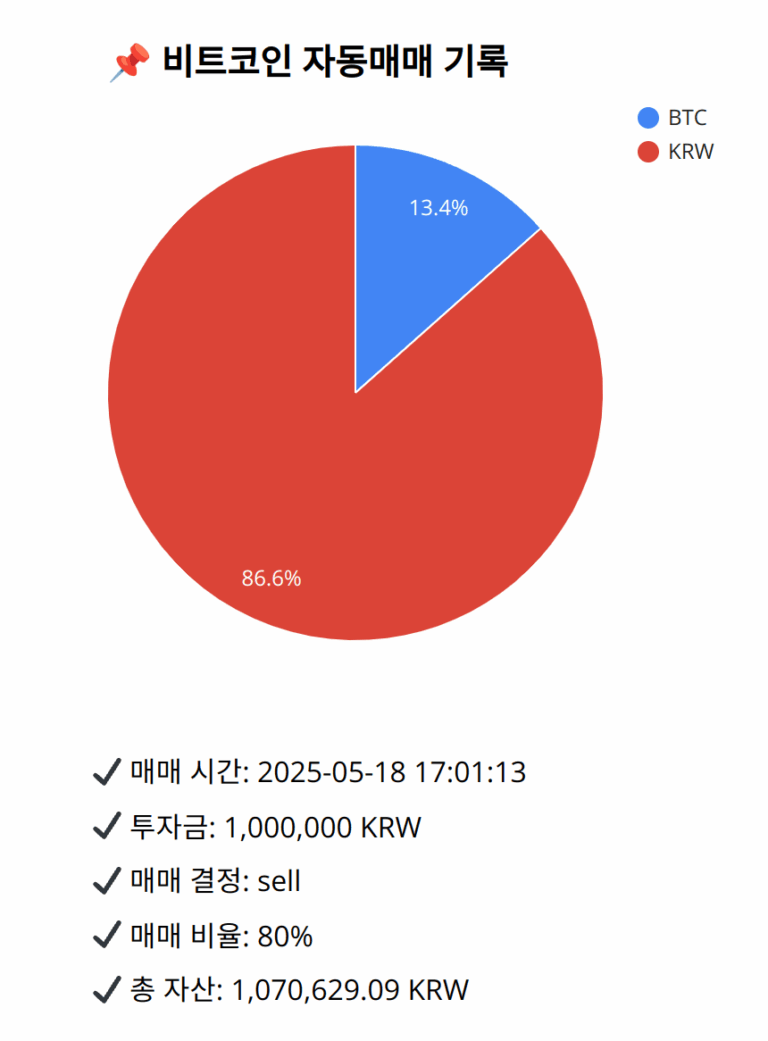

Investment amount: 1,000,000 KRW

BTC current price: 147178000.0 KRW

Reflection: Throughout past 18 trades, consistently correcting positions amidst momentum weakening, especially highlighted by the MACD nearing or moving below the signal line, has helped preserve gains. Recent successes aligned with this strategy have shown its effectiveness in volatile markets, validating its continued application. Previous mistakes often stemmed from overestimating upward potential in similar situations, thus failing to capitalize on protective opportunities. Improvement comes from maintaining a responsive approach to indicator nuances, prioritizing signal clarity over speculative trends during uncertain phases.

Decision: sell

Percentage: 80%

REASON: 1. Latest close price: 147116000

2. SMA values for 5, 20, 60, and 200 days: 146811600, 146263550, 145372716.67, 136104375

3. RSI value: 62.1147738542

4. MACD value: 456665.8453446031

5. MACD signal value: 442342.2003437647

6. Bollinger Band: Middle (bb_bbm): 146263550, Upper (bb_bbh): 147762560.1367235482, Lower (bb_bbl): 144764539.8632764518

The recent data shows that the latest close price is significantly above both 5-day and 20-day SMAs, indicating short-term bullish momentum. However, the MACD is very close to its signal line, suggesting weakening bullish momentum, and the RSI is above 60, nearing overbought conditions. Additionally, the price is close to the upper Bollinger Band, indicating potential resistance. Historical analysis has shown success when reducing exposure during similar conditions where technical indicators suggest potential resistance and weakening momentum. To capitalize on recent gains and protect against a possible downside correction, selling 80% of held BTC aligns with a proven strategy of preserving capital amidst mixed signals and potential resistance.

BTC balance: 0.00097819 BTC

KRW balance: 926661.0451088 KRW

BTC average buy price: 146683659.1883046 KRW

Total assets: 1,070,629.09 KRW