Bitcoin AI Trade Log – 2025 05 18 21:01:11

TIMESTAMP : 2025-05-18 21:01:11

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Over $5B Pouring into Bitcoin ETFs – Thanks to Bold Directional Bets”(05/17/2025, 02:18 PM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

“Is A Bitcoin Supercycle Imminent?”(05/16/2025, 01:11 PM, +0000 UTC)

“Michael Saylor admits Strategy shareholders ‘would suffer’ if Bitcoin were to ‘fall 90% and stay there for 4 or 5 years'”(05/15/2025, 04:54 PM, +0000 UTC)

Trading Log

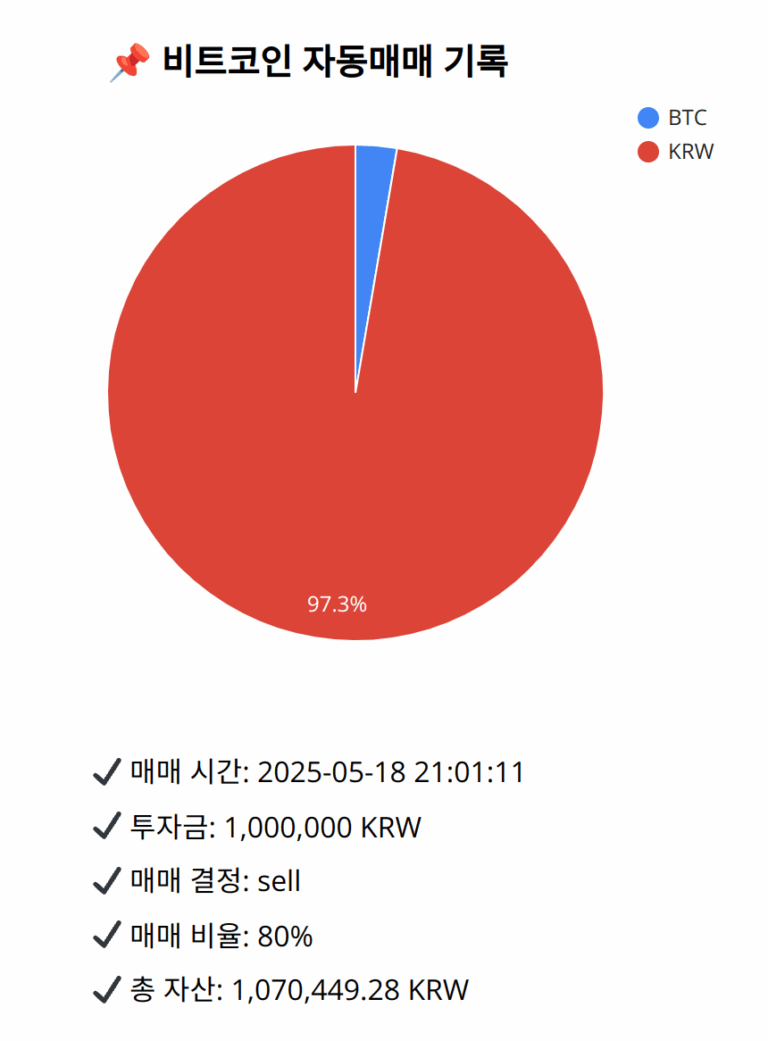

Investment amount: 1,000,000 KRW

BTC current price: 147053000.0 KRW

Reflection: Reflecting on recent trades, notable success came from reducing exposure during mixed signals like nearing Bollinger Band resistance or high RSI readings, allowing gain preservation. Mistakes involved not sufficiently trimming exposure before confirmed downturns, hence underscoring prudent profit-taking strategies. It is beneficial to adhere to tested strategies: capturing gains amidst ambiguous signals, ensuring responsiveness to implications of high market greed and technical indicators pointing to resistance. Improvement could focus on optimizing the timing when mixed signals first emerge.

Ensuring exposure aligns with clear upward trends and declining only when those trends show potential weakness becomes key in enhancing outcomes given the complex market dynamics.

Decision: sell

Percentage: 80%

REASON: 1. Latest close price: 147050000

2. SMA values for 5, 20, 60, and 200 days: 146775000, 146418100, 145457833.33333334, 136219090

3. RSI value: 60.6480649327

4. MACD value: 448998.7106575668

5. MACD signal value: 441797.2630902908

6. Bollinger Band: Middle (bb_bbm): 146418100, Upper (bb_bbh): 147432449.2297998369, Lower (bb_bbl): 145403750.7702001631

The close price is well above the 20-day SMA, indicating a continued uptrend. The MACD is above the signal line, showing bullish momentum, and the RSI suggests the market is nearing overbought conditions. The price is near the upper Bollinger Band, indicating potential resistance. News implies positive sentiments, but a ‘Greed’ sentiment indicates caution. Given these mixed signals and the high RSI, selling a portion to secure gains while maintaining some exposure to continued market strength is advisable. Thus, selling 80% of BTC is prudent under these conditions to preserve gains while staying prepared for potential market corrections.

BTC balance: 0.00019564 BTC

KRW balance: 1041679.83209622 KRW

BTC average buy price: 146683659.1883046 KRW

Total assets: 1,070,449.28 KRW