Bitcoin AI Trade Log – 2025 05 19 01:01:17

TIMESTAMP : 2025-05-19 01:01:17

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Robert Kiyosaki’s Bitcoin Advice: ‘Buy More, Do Not Sell’—BTC to Hit $250K This Year”(05/18/2025, 12:30 AM, +0000 UTC)

“Over $5B Pouring into Bitcoin ETFs – Thanks to Bold Directional Bets”(05/17/2025, 02:18 PM, +0000 UTC)

“On-Chain Data Tips Bitcoin To Peak At $120,000 – But On This Condition”(05/18/2025, 02:30 PM, +0000 UTC)

“This 1 Catalyst Could Send Bitcoin Skyrocketing Higher, According to Silicon Valley Billionaire Tim Draper”(05/18/2025, 10:00 AM, +0000 UTC)

“Serious BlackRock Bitcoin Warning Fuels ‘Disaster’ Fears As The Price Suddenly Dives”(05/15/2025, 11:45 AM, +0000 UTC)

Trading Log

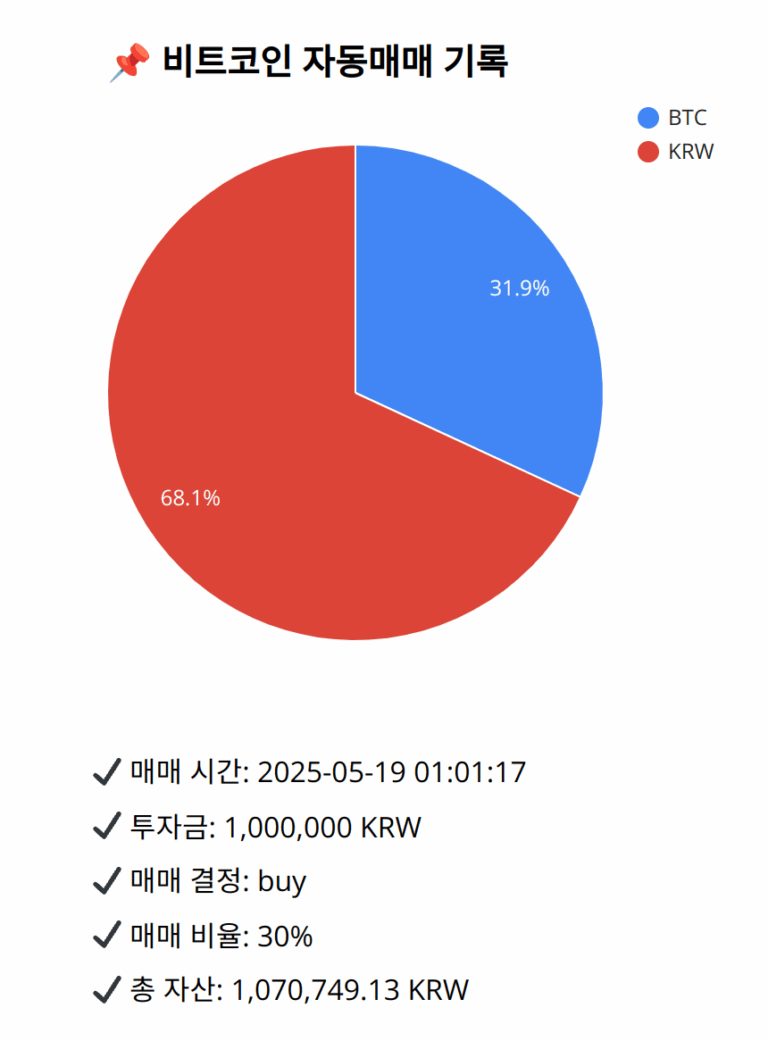

Investment amount: 1,000,000 KRW

BTC current price: 149416000.0 KRW

Reflection: Reflecting on past 18 trades, buying during confirmed bullish trends, especially when a golden cross forms, aligned with supportive market sentiment, often led to positive returns. Mistakes usually involved not adequately scaling positions in line with strong trends. Reviewing these patterns suggests maintaining exposure during strong momentum shifts aligns well with capturing ongoing market movements. By cautiously increasing exposure to 30%, we can leverage the current sentiment and technical strength but remain prepared to adapt if signs of momentum loss emerge.

Decision: buy

Percentage: 30%

REASON: 1. Latest close price: 149422000

2. SMA values for 5, 20, 60, and 200 days: 147904400, 146751750, 145607383.33333334, 136355535

3. RSI value: 74.4077455639

4. MACD value: 765284.2897889316

5. MACD signal value: 533310.8507662083

6. Bollinger Band: Middle (bb_bbm): 146751750, Upper (bb_bbh): 148572354.720964998, Lower (bb_bbl): 144931145.279035002

The latest data indicates robust bullish momentum, demonstrated by the price closing well above the 20-day SMA, and confirmed by a golden cross where the 5-day SMA is significantly above the 20-day SMA. Current RSI is high, suggesting overbought conditions, but it can also align with strong bullish momentum. The MACD is considerably above its signal, showing sustained momentum. The price is nearing the upper Bollinger Band, indicating potential resistance may soon manifest. However, the market sentiment remains greed-oriented with substantial inflows into ETFs, suggesting ongoing bullish potential. Reflecting on past trades, buying during such pullbacks in strong uptrends has been beneficial, so I recommend buying 30% of the available KRW to capitalize on this strength, while being cautious of potential short-term overbought conditions.

BTC balance: 0.00228605 BTC

KRW balance: 729176.68682033 KRW

BTC average buy price: 149184909.72358432 KRW

Total assets: 1,070,749.13 KRW