Bitcoin AI Trade Log – 2025 05 19 13:01:14

TIMESTAMP : 2025-05-19 13:01:14

Market Status

Fear-Greed INDEX: 74 (Greed)

News Headlines

“Bitcoin News: BTC Nears Bullish Golden Cross as Moody’s Downgrades U.S., Citing Debt Concerns”(05/18/2025, 04:58 PM, +0000 UTC)

“Bitcoin Price Suddenly Soars As Congress Predicted To ‘Make History’”(05/18/2025, 04:56 PM, +0000 UTC)

“On-Chain Data Tips Bitcoin To Peak At $120,000 – But On This Condition”(05/18/2025, 08:30 PM, +0000 UTC)

“This 1 Catalyst Could Send Bitcoin Skyrocketing Higher, According to Silicon Valley Billionaire Tim Draper”(05/18/2025, 10:00 AM, +0000 UTC)

“Bitcoin’s Wild Ride: Bulls Charge Toward All-Time High as $27M in Bearish Bets Vanish”(05/18/2025, 04:11 PM, +0000 UTC)

Trading Log

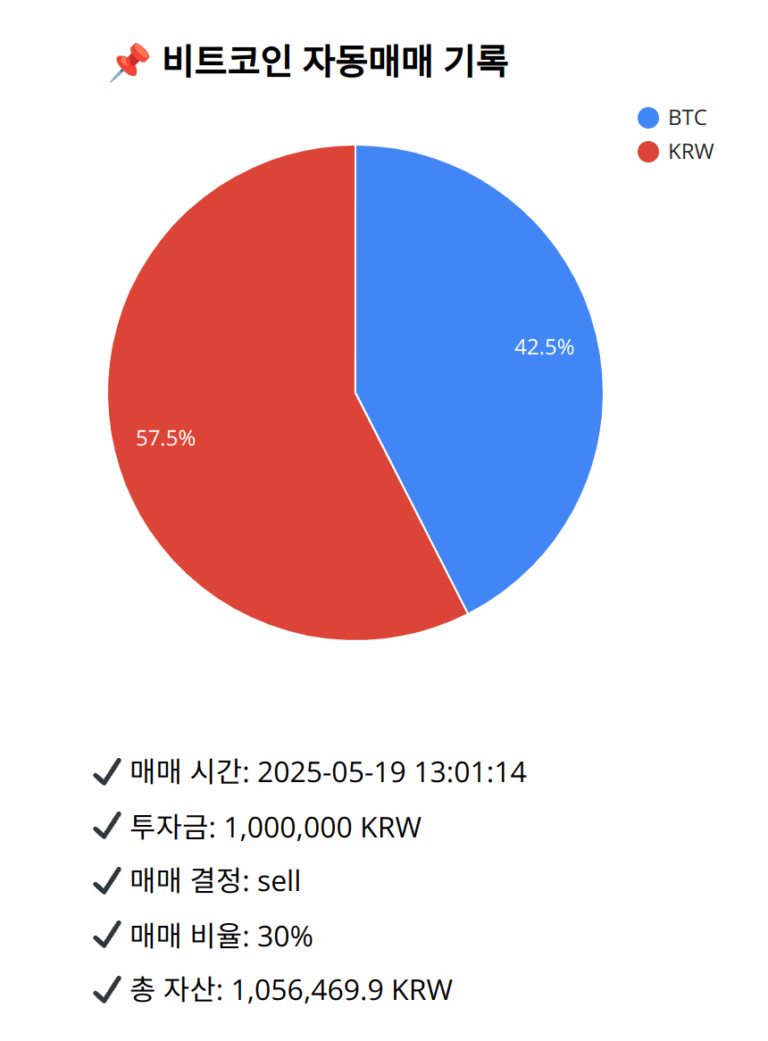

Investment amount: 1,000,000 KRW

BTC current price: 147221000.0 KRW

Reflection: The past 18 trades reveal a reliable pattern of preserving capital by adjusting exposure around technical resistance and momentum weakening signs. Despite potential gains, this caution paid off, especially when mixed signals were present. What worked consistently was choosing to secure existing gains while waiting for clearer trend affirmations, avoiding unnecessary risks. Future resolutions should continue leveraging these insights, ensuring a balance between opportunistic trades amid strong signals, and protective actions when indicators suggest market hesitance or possible reversals. In essence, my strategy effectively captured profits while safeguarding against downturns, learning the importance of flexible, responsive trading to varying market dynamics.

Decision: sell

Percentage: 30%

REASON: 1. Latest close price: 147234000

2. SMA values for 5, 20, 60, and 200 days: 147464800, 146860050, 145892400.0, 136486180

3. RSI value: 65.3645789458

4. MACD value: 776894.2395678983

5. MACD signal value: 698180.1298675432

6. Bollinger Band: Middle (bb_bbm): 146860050, Upper (bb_bbh): 148490735.35683686, Lower (bb_bbl): 145229364.64316314

The close price remains above the 20-day SMA, indicating uptrend continuation. However, the MACD shows some convergence towards the signal line, suggesting potential momentum weakening. With RSI in overbought territory, there’s risk of a pullback. The price also hovers near the upper Bollinger Band, signaling possible resistance. Despite strong bullish signals, reflecting on past trade patterns where gains were best secured during mixed indicators prompts selling 30% of BTC to lock in profits while maintaining exposure to possible further upside. This aligns with historical effectiveness in capital preservation during such conditions. The recent news and strong Fear and Greed Index indicating ‘greed’ further justify this prudent reduction to safeguard gains.

BTC balance: 0.00304979 BTC

KRW balance: 607476.76804852 KRW

BTC average buy price: 150032792.11859736 KRW

Total assets: 1,056,469.9 KRW