Bitcoin AI Trade Log – 2025 05 20 09:01:31

TIMESTAMP : 2025-05-20 09:01:31

Market Status

Fear-Greed INDEX: 71 (Greed)

News Headlines

“Bitcoin Price Suddenly Soars As Congress Predicted To ‘Make History’”(05/18/2025, 04:56 PM, +0000 UTC)

“Bitcoin Price News: BTC Surges Above $106K, Then Dumps, as Traders Lose $600 Million”(05/19/2025, 08:23 AM, +0000 UTC)

“Bitcoin futures data aligns with BTC traders’ hope for new all-time highs”(05/19/2025, 08:45 PM, +0000 UTC)

“Why Is the Crypto Market Down Even After Bitcoin Hit $107K?”(05/19/2025, 05:05 AM, +0000 UTC)

Trading Log

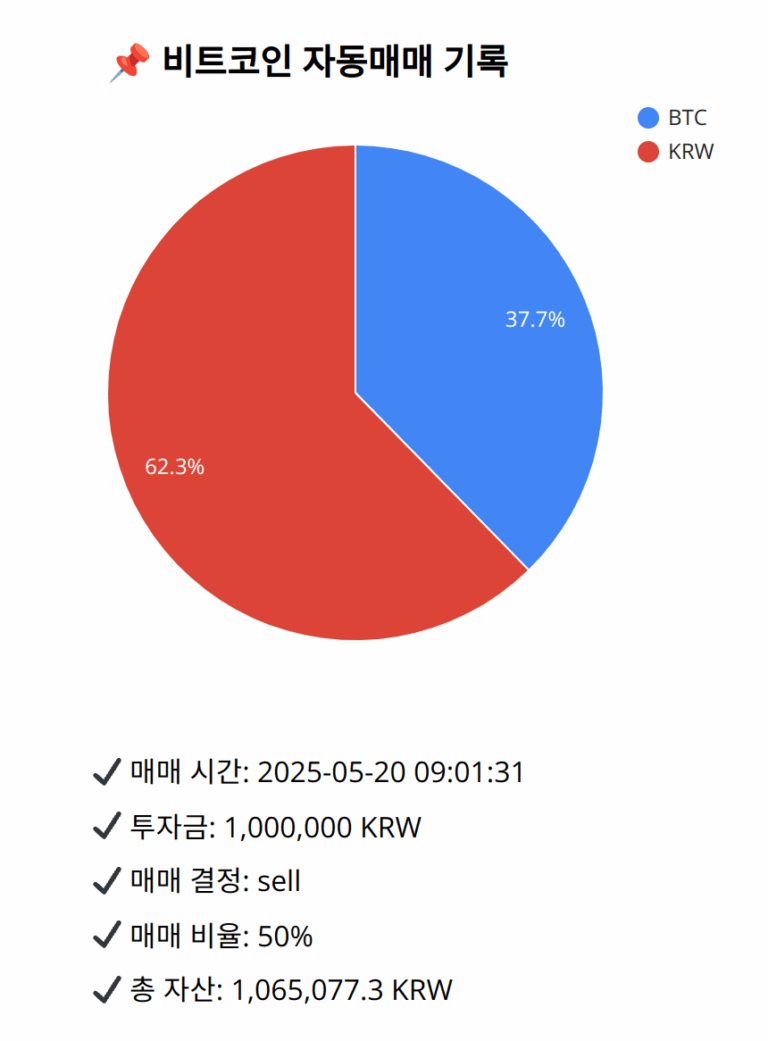

Investment amount: 1,000,000 KRW

BTC current price: 148700000.0 KRW

Reflection: Reflecting on the past 18 trades reveals a consistent strategy of capitalizing on confirmed uptrends through moving average signals, especially golden crosses, while prudently reducing exposure during periods of mixed momentum or nearing resistance levels. Despite general success, missed opportunities often emerged from not leveraging bullish confirmations fully in strong uptrends or hesitating during sentiment-driven momentum. The strategic adjustment of portfolio exposure based on these refined signals consistently optimized risk and returns, although further attunement to rapid market dynamics could enhance timing precision. Going forward, a balanced approach to allocate positions more dynamically according to trend strength and sentiment while maintaining a protective stance during ambiguous signals will support continued trading efficacy.

Decision: sell

Percentage: 50%

REASON: 1. Latest close price: 148576000

2. SMA values for 5, 20, 60, and 200 days: 148116600, 147406500, 146082300, 137379610

3. RSI value: 56.8639352024

4. MACD value: 632670.4518897547

5. MACD signal value: 666674.3342336118

6. Bollinger Band: Middle (bb_bbm): 147406500, Upper (bb_bbh): 149739790.5948466957, Lower (bb_bbl): 145073209.4051533043

The latest close price is above the 20-day SMA, indicating ongoing upward momentum. However, the MACD is below the signal line, showing potential weakness in bullish momentum. The RSI remains neutral, suggesting limited immediate bias towards overbought or oversold conditions. Price proximity to the upper Bollinger Band hints at possible resistance. The latest news indicates market sentiment is strong, yet cautious increase to cash allocation could hedge against overly speculative scenarios. Given past reflections consistently securing gains upon mixed momentum signals, selling 50% of BTC secures profit and aligns with exposure reduction, emphasizing capital protection through increased cash reserve amidst technical uncertainty.

BTC balance: 0.00269864 BTC

KRW balance: 663789.53089264 KRW

BTC average buy price: 148500745.89263728 KRW

Total assets: 1,065,077.3 KRW